2015 is introducing a lot of young people to the idea of a bear market. And article after article is telling us that the downturn is no problem and that young people absolutely shouldn’t sell. This thinking is based on the vastly oversimplified concept of long run returns. That is, the stock market tends to generate positive returns in the long-term so a young investor should always remain overweight stocks and remain aggressive. Then, as they get older their risk profile should change because their time frame changes.

The more simplified version of this thinking is the “age in bonds” concept. So, a 30 year old should have 30% of their portfolio in bonds and a 70 year old should have 70% of their portfolio in bonds. But when I run through personal risk profiles with clients I often find that the exact opposite is true. More often than not it’s the young people who have no stomach for risk. That’s usually due to the fact that their income/expenditures relative to savings is low.

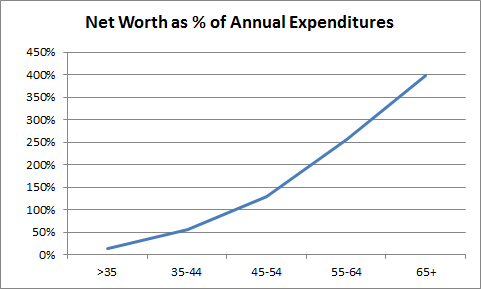

The problem with being young is that your income is low and unstable while your expenses are relatively high. You have the new house, the new kids, the new cars, etc. A young person’s life is front loaded with big expenses. If we look at data from the US Census Bureau and Consumer Expenditure Survey we can put this concept in visual form.¹ As you’ll notice in the chart below, a young person’s net worth is very low relative to their average annual expenditures. In fact, expenditures tend to decline as we get older even as our net worths increase. In essence, our financial situation tends to become more stable and predictable as we get older. This means that young people have a much lower cushion for savings volatility than older people do. As a result, many young people probably have a much lower risk tolerance than Modern Finance leads us to believe.

Unfortunately, modern finance has constructed oversimplified academic models of portfolio construction and ideas like “stocks for the long run” to convince young people that they have a much higher stomach for losses than they often do. And by getting the risk profiles so badly wrong at the start these young investors are more likely to change their portfolios after big downturns when the markets teach them what their real risk profile is. It’s just one more case of reality not matching up very well with theory….²

¹ – https://www.bls.gov/cex/tables.htm & https://www.census.gov/en.html

² – This obviously is not true in the case of many investors in tax deferred accounts who should not touch these funds for several decades or young people who have a surplus of savings, ample emergency funds and “money to burn”.

NB – This post was motivated by this very excellent piece by Allison Schrager at Quartz.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.