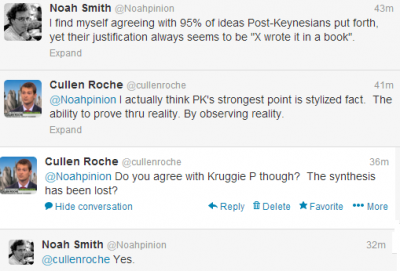

Last week Paul Krugman said the neoclassical synthesis was “lost”. And then I was talking to Noah Smith on Twitter and he declared it officially lost. Yes, Noah Smith has that kind of power so get over it:

For a remote group of nerds this is actually a very exciting potential shift in the way a lot of people will start viewing and thinking about economics. It means that the walls are starting to fall around many of the ideas that have dominated much of economic thought for the last 50 years.

So where will all these economists end up if the synthesis has truly been lost? Well, I don’t want to be presumptuous, but actually I do. There is simply no school of thought during the crisis that has performed better than the Post-Keynesian schools. As I previously explained, PKers predicted:

- That the expansion of QE wouldn’t cause hyperinflation.

- That the USA wasn’t going to suffer from a Greek crisis.

- That Europe’s monetary system was fundamentally flawed and likely to suffer enormously.

- That the stimulus wasn’t nearly as “stimulative” as most presumed.

- That the “balance sheet recession” and consumer credit crisis would hamper the economy for years.

- That interest rates weren’t going to rise as a result of the government’s spending.

- That corporate profits were going to boom due to the government’s deficit.

And I think that’s largely the result of a superior framework. It’s the result of looking at stylized fact, double entry bookkeeping, understanding sectoral balances and the flow of funds in the system, understanding accounting identities based on an operational understanding, understanding how banks matter in an economic model because they issue most money, etc. It’s not politics. It’s about trying to look at what is so we can better understand what might happen due to certain economic and policy changes.

So, the synthesis might have been lost, but something much greater has been gained. Specifically, a more realistic view of our economy and the monetary system. Now let’s hope the synthesis doesn’t find its way back….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.