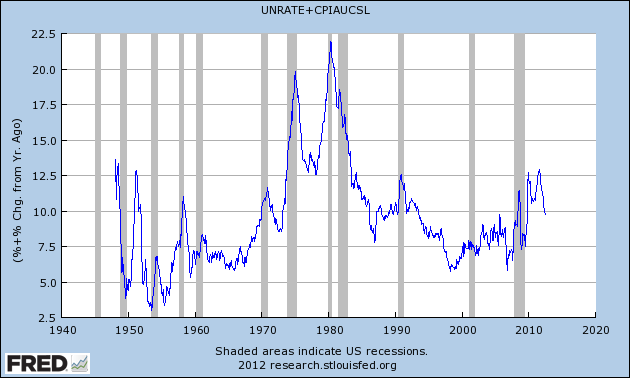

We posted the misery index for Spain earlier today so it might be helpful to put things into context here in the USA as well. In case you don’t know, the misery index is:

“The misery index is an economic indicator, created by economist Arthur Okun, and found by adding the unemployment rate to the inflation rate. It is assumed that both a higher rate of unemployment and a worsening of inflation create economic and social costs for a country.”

What is this index telling us today? As you can see below, the index has actually come down quite a bit since the drop in inflation has occurred over the last few months. At just under 10% it remains high by historical standards, but is off the highs of 12.5%+ seen in the last few years.

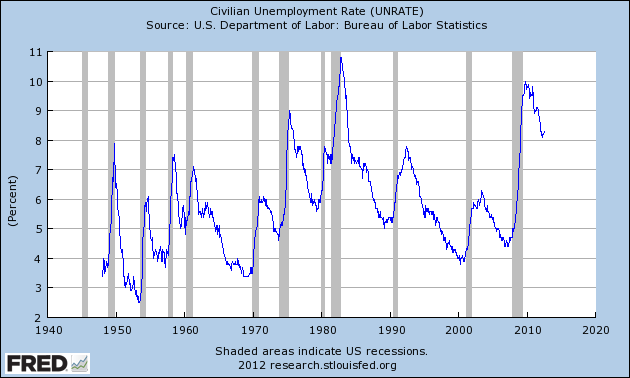

Perhaps more importantly though, the lack of inflation in this de-leveraging environment is consistent with an unacceptably low rate of growth which is directly tied to the high unemployment rate. So let’s not let the decline in the index fool you. Despite improvement here the misery of the unemployed remains very high at 8.3%, which, by historical standards remains very high.

Misery Index – The Long View

Unemployment Rate

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.