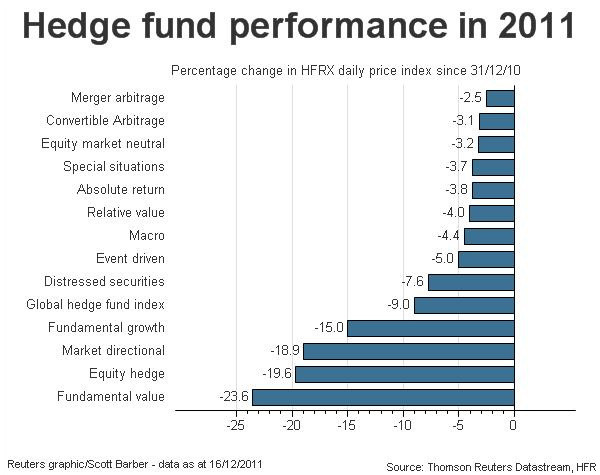

With the S&P 500 up about 1% this year after dividends and the long bond generating a whopping 31% return it’s safe to say that the hedge fund industry hasn’t added much value this year. As of 12/16 all of the major hedge fund strategies are in the red for the year (via Thomson Reuters):

“A decade ago, hedge funds consolidated their reputation by offering investors safe haven from market turmoil and generating returns in tough times. Not now, however. Not a single major hedge fund strategy is on track to end the year with a profit, with only a week or so left of trading. Worst hit were the value strategies, with many cheap stocks – like banks – proving to be value traps, just getting cheaper with every month that passed.”

Source: Thomson Reuters

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.