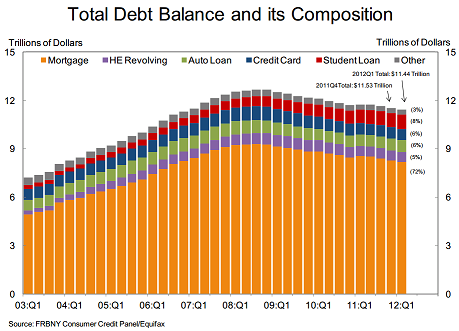

While Europe steals the spotlight on the problems in the global economy, the US economy continues to muddle through its consumer credit recession. The latest Household Debt and Credit Report from the NY Fed shows continued signs of de-leveraging.

“Aggregate consumer debt fell slightly in the first quarter. As of March 31, 2012, total consumer indebtedness was $11.44 trillion, a reduction of $100 billion (0.9%) from its December 31, 2011 level. Mortgage balances shown on consumer credit reports fell again ($81 billion or 1.0%) during the quarter; home equity lines of credit (HELOC) balances fell by $15 billion (2.4%). Household mortgage and HELOC indebtedness are now 11.9% and 14.3%, respectively, below their peaks. Consumer indebtedness excluding mortgage and HELOC balances stood at $2.64 trillion at the close of the quarter. Student loan indebtedness, the largest component of household debt other than mortgages, rose 3.4% in the quarter, to $904 billion.”

The vast majority of the decline came from mortgage related debt, which, not surprisingly makes up the biggest piece of the consumer debt pie. As Robert Shiller noted in this most recent interview, the problem with real estate is not that houses aren’t affordable, but that people simply don’t have the demand for the extra debt. This is clear proof that he’s right. I still see the effects of the credit recession tapering off into 2013, but it’s clear that the problems are still impacting the US economy today.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.