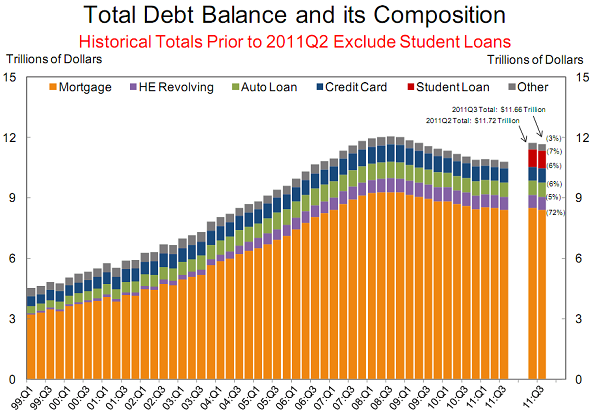

The latest quarterly credit report from the NY Fed shows continued de-leveraging at the consumer level. The consumer credit recession continues unabated. Highlights from the report are attached (via NY Fed):

“Aggregate consumer debt fell approximately $60 billion to $11.66 trillion in the third quarter of 2011 according to the Federal Reserve Bank of New York’s latest Quarterly Report on Household Debt and Credit. Total consumer indebtedness decreased roughly 0.6 percent from revised second quarter findings of $11.72 trillion.1 The newly issued report also presents information on various aspects of consumer debt, including continuing and emerging trends for mortgage balances, delinquencies, foreclosures and other consumer credit activity.

“The decline in outstanding consumer debt reveals that households continue to try and deleverage in the wake of a challenging economic environment and large declines in home values,” said Andrew Haughwout, vice president in the Research and Statistics Group at the New York Fed. “However, our findings also provide evidence that consumer credit demand continues to increase, a positive sign for consumer sentiment.”

Highlights from the report include:

- Mortgage balances on consumer credit reports fell by approximately $114 billion or 1.3 percent over the third quarter while home equity lines of credit balances increased by roughly $14 billion or 2.3 percent.

- Non-real estate indebtedness now stands at $2.62 trillion, about 1.3 percent above its Q2 level.

- Aggregate credit card limits declined by about $25 billion slightly offsetting increases from earlier this year.

- Open credit card accounts declined by 6 million to 383 million in the third quarter and credit card borrowing limits fell again, partially offsetting some gains seen earlier in the year.

- Open credit card accounts for third quarter were approximately 23 percent below the peak in second quarter 2008 and balances on those cards were nearly 20 percent below their highest levels in fourth quarter 2008.

- Credit account inquiries within six months, an indicator of consumer credit demand, increased for the second quarter in a row.

- Overall delinquency rates increased to 10 percent as of the end of September, compared with 9.8 percent at the end of June.

- Approximately $1.2 trillion of consumer debt is delinquent with $834 billion being seriously delinquent (more than 90 days).

- About 2.5 percent of current mortgage balances transitioned into delinquency in the third quarter, reversing a recent trend of reductions in this measure.

- New foreclosures decreased 7 percent quarter over quarter and bankruptcies declined

18.8 percent year over year.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.