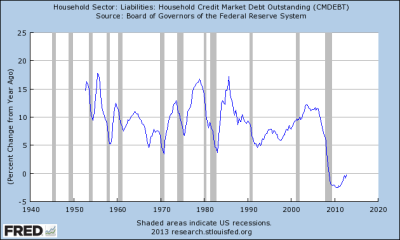

The latest NY Fed report on household debt showed continued de-leveraging, but continued improvement in many trends:

“Aggregate consumer debt declined in the first quarter, by $110 billion, resuming the longer-term downward trend. As of March 31, 2013, total consumer indebtedness was $11.23 trillion, 1.0% lower than its level in the fourth quarter of 2012. Overall consumer debt remains considerably below its peak of $12.68 trillion in 2008Q3.

Mortgages, the largest component of household debt, fell in the first quarter of 2013. Mortgage balances shown on consumer credit reports stand at $7.93 trillion, down $101 billion from the level in the fourth quarter of 2012. Balances on home equity lines of credit (HELOC) dropped by $11 billion (2.0%) and now stand at $552 billion. Household non-housing debt balances were roughly flat, with increases in auto and student loans, by $11 billion and $20 billion respectively, offset by decreases in credit card balances ($19 billion) and other consumer loan balances ($10 billion).”

Technically, it’s still a de-leveraging, but this is a story about gradual improvement. And this de-leveraging has essentially slowed to a trickle at this point and is likely to turn positive in the coming quarters. I wouldn’t declare the Balance Sheet Recession in the USA over, but its impact is certainly waning.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.