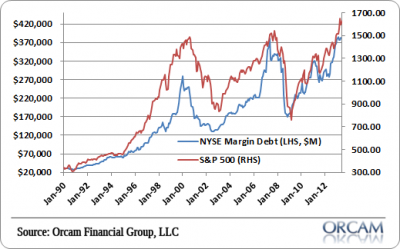

The latest reading on NYSE margin debt was just shy of an all-time high. Borrowing to execute securities trades has not waned much at all in recent months as the July data showed borrowing of $382.1B which was slightly below the all-time record of $384.3B seen in April of this year. The July reading is up from $376B in June. Clearly, there’s still a lot of confidence in the minds of traders who are borrowing to execute trades as NYSE margin debt balances certainly appear to have a long-only bias:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.