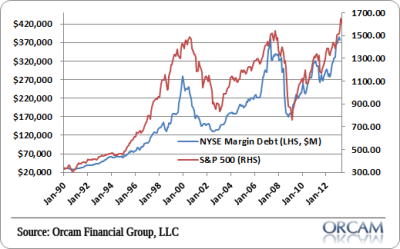

NYSE margin debt declined to $377MM in May from April’s record reading of $384MM. This was the first decline on a monthly basis since last June.

Historically, margin debt has a strong correlation with the S&P 500 as investors tend to lever up as the market advances and the mood shifts from risk off to risk on. I often refer to this as evidence of a disaggregation of credit or the way credit is often employed in our economy for productive and unproductive uses.

As we saw in Japan just recently, the surge in margin debt coincided with a huge run-up in stocks and the subsequent collapse in stocks. Leverage, as we all know, can be a very dangerous thing when employed improperly.

The most recent margin debt reading in the USA doesn’t mean that we’ve seen a peak in the metric, but it’s certainly worth keeping an eye on as margin debt has led both of the recent major market tops by about a quarter.

Chart via Orcam Investment Research:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.