I noticed this story on Owners Equivalent Rent on the Atlanta Fed’s blog today. It discusses the rationale behind using what the Bureau of Labor Statistics calls “Owners Equivalent Rent” in their CPI calculation. Specifically, they say:

“This begs the question: In light of the recent strength seen in the housing market—and notably the nearly 10 percent rise in home prices over the past 12 months—are housing costs likely to exert more upward pressure on the CPI?

Before we dive into this question, it’s important to understand that home prices do not directly enter into the computation of the CPI (or the personal consumption expenditures [PCE] price index, for that matter). This is because a home is an asset, and an increase in its value does not impose a “cost” on the homeowner.”

The BLS says housing is not consumption, but investment so they don’t include it in the CPI calculation. They rationalize this thinking by stating not only that housing “does not impose a ‘cost’ on the homeowner”, but also that “House prices frequently appreciate; in this respect they differ from consumer durables such as vehicles.” These two statements are somewhat misleading. Let me elaborate.

First of all, most houses are definitely depreciating assets. From the second you build a new home someone else is building the same home with more innovative and updated technologies. Further, it’s the structure that depreciates while the land appreciates due to its scarcity. A house is like a car that sits on a plot of land. The primary reason why homes don’t decline in value is because the land appreciates in value and the physical structure is frequently updated (in addition to other reasons). This is a real cost to the homeowner over the life of the house. In other words, the house is partially consumed over time while the land appreciates.

The other substantial cost in “owning” a home is the mortgage. This debt burden is real consumption. It is the cost of being able to afford the property in the first place. Most of us do not buy our homes outright and the mortgage imposes a massive cost on the homeowner. The word mortgage is derived from the latin meaning “death contract”. Not only is mortgage debt the largest portion of consumer debt (approximately 75% of all debt), but it also accounts for about 75% of the cost of the home over the life of a standard 30 year mortgage (ie, you will pay about 75% of the cost of the home in interest ALONE over a 30 year period). In other words, a mortgage is a lot like consuming your home bit by bit. Taken together, the mortgage and the upkeep of homeownership are substantial costs that most people simply don’t include in their total return calculations of real estate prices leading them to say silly things like “house prices frequently appreciate”. By treating all houses as owners equivalent rent they ignore the fact that there are important elements of consumption in owning real estate.

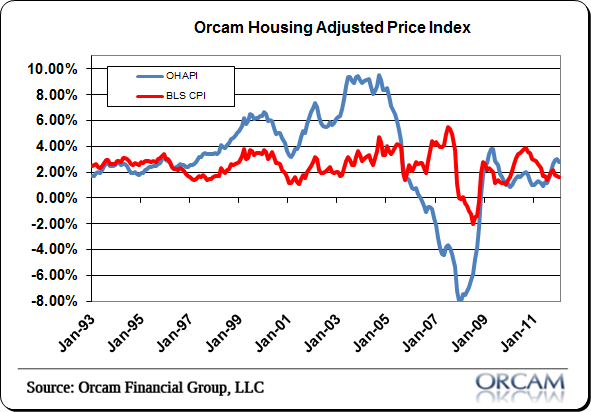

This was clearly a problematic view during the last 10 years when the real cost of a home caused huge problems for the economy as mortgage resets were one clear cause of the balance sheet recession. Had we been paying more closely to house prices we might have noticed a disequilibrium in the economy a bit sooner than we did. But the Fed and the BLS were focused largely on OER and thus a benign looking CPI reading. My adjusted housing price index is far from perfect, but were we using something like this in conjunction with the CPI I think we would have had a much clearer picture of the potential problems in the economy and the supply imbalances that were potentially creeping into the housing sector. Instead, this flawed view of the consumers most important asset price helped lead us blindly right over a cliff.

(Chart via Orcam Financial Group)

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.