In a research report this morning Liz Ann Sonders of Charles Schwab discussed the prospects of QE3:

“… what about QE3?

Bernanke didn’t quite close the door on QE3, but made it seem much less likely, noting the “trade-offs” are getting “less attractive” and the need to keep “inflation under control.” This suggests that even if QE3’s not off the table, the bar is set pretty high for its initiation.That’s great news to us, having believed for some time that the risks of another round of quantitative easing greatly outweigh the benefits.”

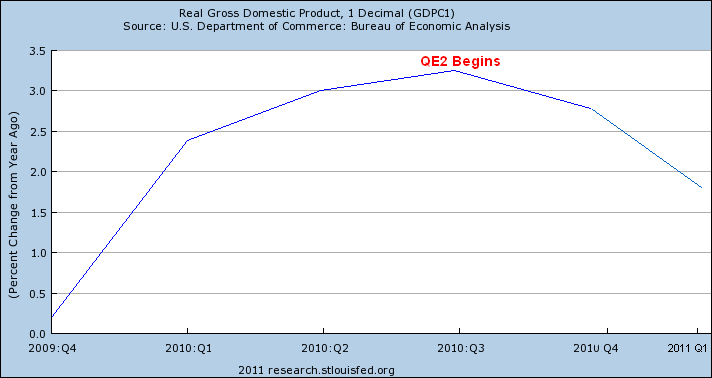

Ben Bernanke showed his cards yesterday and it looks like he’s leaning towards completing QE2 and is hesitant to consider QE3. This is a welcome development for the US economy. Despite persistent chatter about QE3 the evidence is beginning to show that QE2 was not the panacea that so many expected it to be. In fact, I have yet to see one good argument proving that QE2 did anything positive. The final nail in the coffin should be this morning’s GDP figures for Q1. Real GDP, at just 1.8%, has been on the decline ever since the program started!

The Fed has attempted to deny that QE2 had any damaging impact on the US economy. And while that might be up for debate, the mere fact that we are having a debate over it should be enough for the Fed to stop with “experimental” policies. Sometimes, it’s best just to cut your losses. The bottom line is that QE is not helping the US economy at this juncture according to the growth data. In fact, this program cannot help the US economy at this juncture. This is crystal clear to anyone who understands how a modern banking system works. As I’ve previously discussed, this program was destined to fail from the beginning due to its focus on size and not price. The very thought of QE3 should be absurd to anyone who is objectively studying the transmission mechanism through which QE works and its clear results from the last 8 months.

If the Fed were to attempt to correct its errors in implementation via QE3 (by targeting price) I fear the cries over “debt monetization” and “money printing” would be even worse than they were during QE2. Despite their arguments to the contrary, it’s clear to anyone with a functioning set of eyes that the Fed has sparked a massive boom in speculative commodity bets. This has been a direct contributor to the slow-down in real GDP. Were the markets to begin pricing in QE3 I fear this would only exacerbate the current situation. “Transitory” inflation could become something worse. Because of that, I believe it is best that we simply step back from the operating table and accept the fact that this is not the time to be experimenting with the livelihoods of American citizens.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.