The Council on Foreign Relations highlights the weakness of the recent economic recovery in their quarterly update (via Warren Mosler):

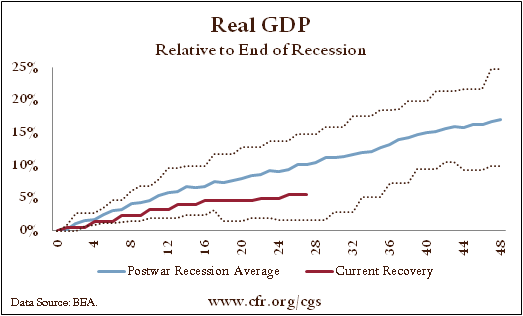

- Real GDP is growing, but weakly compared with the postwar average recovery.

- The recovery from the 1980 recession was even weaker at this stage, but that reflected a double-dip recession in 1981.

- The economy would have to grow at a 7.6 percent annualized rate in order to catch up with the average postwar recovery by the end of 2012.

- The consensus forecast for 2012 growth as reported by Bloomberg is 2.1 percent, up just slightly from a forecast of 2.0 percent as of last October.

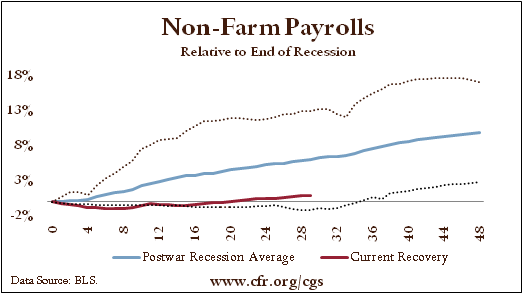

- The slow recovery is obvious in the labor market, where job growth remains painfully sluggish compared to the average recovery.

- The recent uptick at the end of the Current Recovery linev(red) is the result of encouraging payroll data announced on January 6th 2012.

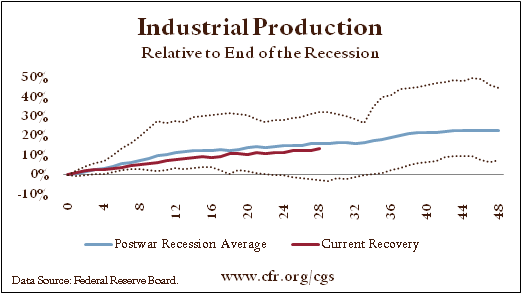

- Because of the depth of the recent recession, one might expect stronger-than-average improvement in industrial production.

- Despite the predicted snapback, the increase in industrial production during this recovery is actually slightly slower than in the average postwar case.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.