I specialize in building relatively conservative “all weather” style indexing portfolios. They are designed for people who have a reasonably long time horizon (at least 5-10 years), don’t want to go through another 2008, but also want to generate a decent return above the rate of inflation.

This means I end up managing a lot of fixed income because being a long only equity manager would expose investors to too much 2008 risk and owning cash guarantees a negative inflation adjusted return. So bonds HAVE to fit into a multi-asset allocation.

This creates a whole different problem – most of my clients aren’t that comfortable with bonds, either because they don’t have much experience with them or have been trained to think that interest rates must rise (because they’re low) and that that means doom for bonds. But if you want to properly allocate your assets in a strategy that will sufficiently hedge against a 2008 style risk while also beating cash you virtually HAVE to get comfortable with bonds.¹ So here are a few tips on overcoming your fear of bonds:

1) Get your time horizon right and stop thinking so short-term! The best part of the bond market is that you know precisely what your time horizon should be. If you buy a 10 year bond and you judge it based on 10 month performance then you’re doing it all wrong. You buy the 10 year bond precisely because you can establish what your time horizon is and if you’re buying a high quality bond you know with a high degree of certainty that you will earn a consistent yield while getting your principal back at maturity.

If you’ve got 10 years to invest and you can’t take pure stock market risk (for whatever reason, behavioral or other) then you can plop the money into a specific 10 year bond and know with fairly high certainty how much money you’ll have after 10 years. This beats cash and also beats the uncertainty of what stocks might do over those 10 years. But treating that 10 year bond as anything other than a 10 year time horizon is using the product incorrectly. It’s literally designed to be a 10 year product so judging it on short time horizons is like buying a 12 month CD that pays 1 coupon upon maturity and then getting upset every day it doesn’t pay you a coupon. Short-termism is the biggest destroyer of behavioral alpha in the financial markets.²

2) Get over your fear of “bond funds”. Many investors think there’s increased risk in a bond fund because it can’t be held to maturity like an individual bond, but a bond fund is nothing more than a portfolio of individual bonds. The key difference is that they have a “constant maturity” in most cases. This is a lot like a bond ladder in that the portfolio does have an average maturity, but it gets reinvested at higher or lower yields as parts of the portfolio mature over time. So, if you buy a bond fund with an average effective maturity of 10 years that’s a heckuva lot like owning an individual bond with a 10 year maturity. The key difference is that the bond fund diversifies out most of that single entity risk.

Another risk with bond funds is that you can see their minute by minute price changes. This is great for liquidity and transparency and terrible for behavioral alpha because the price changes make the bonds look much more volatile in the short-term than they will be in the long-term. My tip is this – if you buy a 10 year bond then it’s fine to look at its price on a 10 minute basis, but just remember that that’s mostly noise.

A related risk here is individual fund risk. For instance, you might own multiple bond funds across different sectors of the global economy. These funds should be allocated so that they’re consistent with whatever your overall fixed income goal is, but it’s important not to think of these funds as individual securities and instead think of the entire bond piece as one bond fund. This way you reduce the risk that you’ll focus excessively on the worst performing parts of the bond portfolio when you should be thinking of how the entire parts are working together. And remember, the goal of diversifying is to reduce cross-asset correlations so if you’re diversified and something in your portfolio isn’t working then it means you’re doing it right!

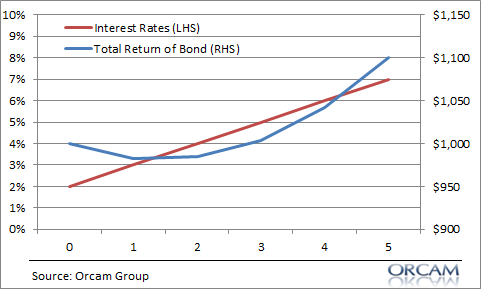

3) Get over your fear of rising rates. We are trained to think that interest rates and bond prices are inversely correlated, but the reality is that rising interest rates cause bond prices to fall in the short-term, but do not impact the long-term coupon payments that that bond is structured to pay. Take, for instance, the case of a 5 year bond with a face value of $1,000 paying 2% per year. If interest rates rise by 1% every year that bond still pays you 2% every year plus you get your principal upon maturity. The chart below shows how the total return of that bond looks over the course of your 5 years.

Misjudging this bond is another case of short-termism. If you only have 3 years and you’re buying a 5 year bond then you’re buying the wrong product. If, however, you’ve properly aligned your time horizon with your bonds then there is no risk of principal loss due to interest rate risk.

- Bonds Don’t Necessarily Lose Value if Rates Rise

- What is the Worst Case Scenario for Bonds?

- What Will Happen to Bonds if Interest Rates Normalize?

4) Get over your fear of inflation! If inflation rises a whole bunch then your bonds will still earn money in nominal terms, but will lose money in real terms. Inflation is bad for bonds. But it’s worse for cash because it earns a lower average yield. But here’s the bigger issue – you don’t buy bonds for inflation protection. If you want inflation protection you buy stocks or other assets that are designed to generate a return above the cost of production (inflation, after all, is basically the cost of production). You buy bonds as a cheap form of insurance that protects your equity slice from volatility while also earning a higher yield than cash. So, if you’re worried about how inflation will impact bonds in a multi-asset portfolio then you’re thinking about your bonds inappropriately relative to the rest of your other assets (which should be offsetting your inflation risk).

It takes a lot of discipline to own bonds because they’re incredibly boring products that will at times expose you to principal losses. That will test most people’s patience, but I hope these tips help alleviate some fears and put bond returns and risks in the proper perspective.

¹ – The alternative option is to pay through the nose for various forms of high fee active management, something we know, for a fact, is a generally unwise thing to do.

² – Keep in mind that all bonds are not created equal. Some bonds, like high yield bonds or foreign bonds often look like stocks when you most need them to look like bonds (like 2008). In this sense, it makes sense to be somewhat selective about the types of bonds you hold as you’re looking for holdings that specifically hedge your equity risk as opposed to instruments like high yield bonds which will tend to be highly correlated to stocks when you most need them to be uncorrelated.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.