The new sales pitch for the high fee active manager goes something like this:

“passive investing has gotten so large that this creates greater opportunities for us to take advantage of these inefficiencies and outperform the market.”

In fairness, this comment is partly true because more passive investors should create the need for more active investors (in the form of market making, index arbitrage opportunities, etc.) but it doesn’t mean traditional active managers will be the beneficiaries. The reason why is simple – as I explained in my new paper, there is no such thing as “alpha” or excess return at the macro level. There is only the post-tax and post-fee return of “the market” portfolio of all financial assets. Within this portfolio, it’s been shown that those who deviate actively from this one true passive portfolio (which is everyone, by the way) have a very (or “very, very” for Trumpian emphasis) difficult time consistently outperforming the market. The arithmetic of active asset allocation is too daunting to overcome consistently.

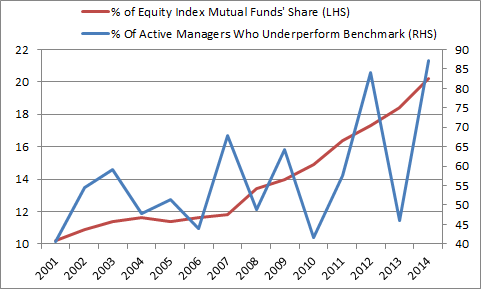

The annual SPIVA Scorecards have shown that fewer than 20% of active managers generate consistent excess return. And despite the tremendous rise in indexing over the last 20 years, this data has not improved for the high fee active manager. In fact, according to ICI and S&P there is a strong correlation between the rise in indexing and the underperformance of active managers. If anything, the rise of indexing appears to be making it more difficult for traditional active managers to outperform.

So, the data clearly debunks this idea that the rise of passive investing will result in better average performance for high fee active managers.¹ But this recent piece in The New Yorker went even further. It doesn’t just say that investors could be worse off, it says the real economy is worse off as a result of passive investing. Let’s explore some of these claims in more detail.

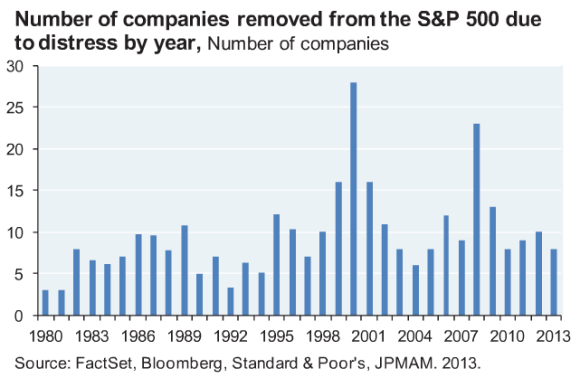

One of the more common claims about the rise of passive indexing is that it creates one static market where the largest market cap firms are perennial beneficiaries of their established place in the market. But this is factually untrue. According to JP Morgan, since 1980 there have been 320 deletions in the S&P 500 due to distress.² This supposedly “passive” index has actually been quite active as its members change based on whether they meet the rules based criteria of the index. Indeed, as indexing has grown, the number of members leaving the index has increased. The data clearly doesn’t confirm this idea that those firms in an index will necessarily benefit solely from being a member in a market cap weighted index.

This gets to a more fundamental point about index funds and passive investors in general. A secondary market is little more than the market’s best guess about the future underlying fundamentals of the actual companies. We shouldn’t confuse “the market” with “the economy” and its underlying firms. They are not the same thing and no matter how robotic “the market” becomes it does not mean the market will simply reflect some robotic pricing of the performance of the actual underlying firms in that market.

For instance, Apple’s corporate performance does not necessarily change because it is a member of the S&P 500 or any other index nor does its market cap remain elevated simply because it is a member. This is due to the fact that passive indexers rely on active arbitrageurs to set prices. In other words, passive indexers are price takers, whereas active traders are price setters. Specifically, an index fund that purchases a certain amount of Apple every day is simply taking the price of the market. It is indiscriminate in its buying whereas an active trader is a more fickle buyer. If Apple reports bad earnings the index might continue to buy regardless of price, however, the active trader will likely pull orders completely. In this sense, the index funds are not the marginal price setter because they are nothing more than a price taker at all times. If Apple’s underlying fundamentals falter we can very much expect it to join the other 320 firms who have fallen out of the S&P 500 due to distress over the last 35 years as more active traders bid down the price until the stock no longer meets the criteria established by the index funds buying the stock.

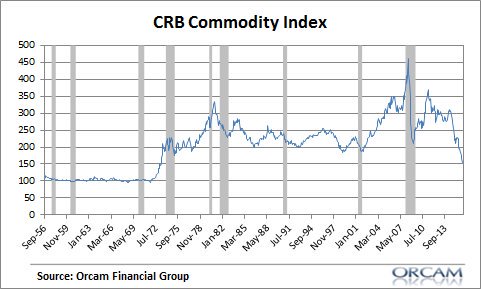

The New Yorker piece also cites a study on commodities futures claiming that passive indexing in commodity funds might “make it harder for the manufacturer to predict demand, potentially driving up costs.” This can’t possibly be right in the aggregate since commodities prices have fallen to levels that we haven’t seen since well before the introduction of commodity index funds. Perhaps prices are higher than they otherwise would be, but this is a counterfactual that we cannot quantify. What we can quantify is that aggregate commodity prices are nearing their lowest levels in 50 years, long before any commodity index had any potential impact on market prices.

The article then asserts that banks who are members in an index tend to charge higher fees thereby hurting consumers. As someone who’s well versed in banking I suspect this has nothing to do with membership in index funds and more to do with the oligopolistic nature of large banks. There have been mountains of evidence showing that the largest banks in the USA and around the world have a growing tendency to act as an oligopoly to benefit one another. The fact that these banks also happen to be included in index funds does not mean that the index funds are to blame for their behavior. We are, once again, confusing the cart for the horse here.

The article also notes several fallacies of composition regarding rising consumer prices in certain industries (such as chocolate) citing the coinciding growth in indexing, but this again looks problematic when compared with aggregate data. CPI growth is at the lowest levels we’ve seen in decades. If anything, the growth in indexing appears to be negatively correlated with consumer prices.

All in all, I don’t see the rise of indexing as being problematic for the real economy or the financial markets. In fact, I see the rise of indexing as an overwhelming positive for consumers as it creates access to liquid markets at very low costs. Importantly though, passive indexing will always rely on some degree of active investing as passive indexers pay active investors to implement their strategy for them. This incentivizes active management particularly in the form of market making and ensures that passive indexing cannot exist without an active component. Index funds and ETFs are some of the greatest financial innovations of the last 50 years.³ Don’t let anyone fool you otherwise.

¹ – A similar concern is that cited by investors like Bill Ackman who claim that the rise of indexing might coincide with a lack of management oversight. This also makes little sense, however, since the data clearly shows that active investors are no better at understanding public companies than anyone else. Why should we trust activist investors to be better stewards of capital than the management who runs those firms when the data so clearly shows that public market investors are simply not very good at picking the best firms in the first place?

² – See “The Agony and the Ecstasy; The Risks and Rewards of a Concentrated Stock Position”, by JP Morgan

³ – The idea of an “index fund” is becoming increasingly nebulous in a world where there is a new ETF or index every day for some new type of “index”. Market cap weighted index funds are not the only influencers in this space.

Related:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.