One of my favorite things to think about in investing is the theoretical investor who slept through 1987. We all know about “Black Monday”, the crash of 1987, when stocks fell 23% in one day. It was terrifying. But the craziest thing about 1987 is that the S&P 500 had a total return of 5.81% that year. The stock market was positive in a year that is known for being a terrifying crash! So, if you had checked your portfolio on January 1, 1987 and then slept through the entire year and woken on December 31st you would have looked at your portfolio and said “huh, pretty slow year in the markets, but not bad!”

This is one of the great paradoxes of investing – the more you pay attention the more behavioral risk you create for yourself. Most people think it’s the opposite. They think they have to keep a watchful eye over their money or it might get up and walk away. But the opposite is true for the financial markets. The assets we own are inherently long-term instruments and no matter how much you trade them or try to make them do certain things they are inherently designed to generate a certain return over medium to long-term time horizons. The more we play around with them the more we incur taxes and fees along the way. The patient investor knows this and let’s the market do what it’s gonna do while the impatient investor tries to make the market do something it cannot mathematically do.

The last 12 months are a great example of how the patient investor sees the world more clearly. Keep in mind, I hate 12 month time horizons. They are not nearly long enough to reasonably judge instruments like stocks and bonds. But you’ll get the point.

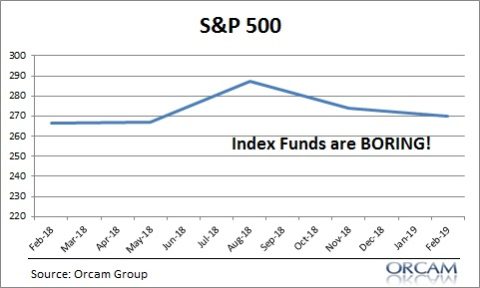

This first chart is like our investor who sleeps through 1987 except they wake up 4 times a year and peak at the quarterly closing prices for the S&P 500 over the last year. This investor sees a pretty mild total return of 1.3% and a max drawdown of 6%. On the whole, the last 12 months look pretty boring.

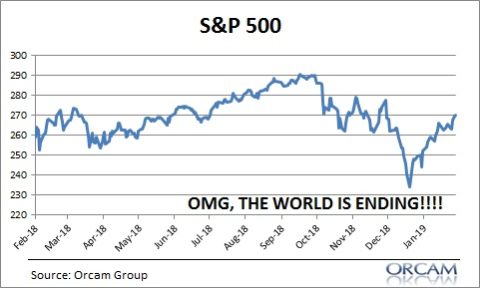

Now let’s take the daily closing prices trying to mimic the investor who obsessively checks their account every day. This person sees every gyration and a fairly traumatic 20% decline late last year. They see the exact same 1.3% total return, but they endure that 1.3% with substantially more volatility thereby resulting in significantly more behavioral risk.

Patience is the intelligent investor’s greatest strength. In part, because by being blinded to the behavioral risks of the markets they make themselves more resilient to the natural volatility of the market. In other words, by seeing less of the market moves they see them more accurately. As a result of this the patient investor better aligns their behavior with the operational design of the underlying instruments they own thereby reducing the risk of mistakes and increasing their likely total return.

NB – Of course, the only thing smarter than not paying attention to the markets every day is reading the blog of someone who does pay attention to the markets every day, has the discipline not to act and knows when you should panic or not.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.