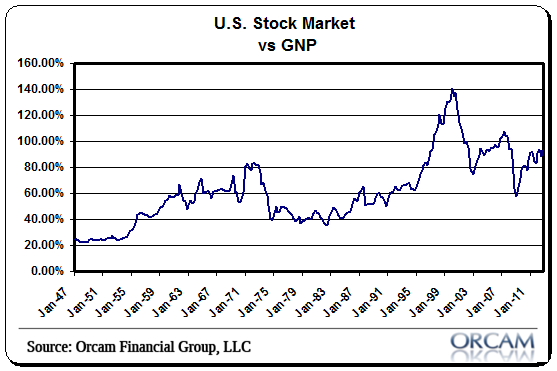

I liked this post over at Monevator discussing the limitations of the Buffett Valuation metric – Market Cap vs GNP. Like most valuation metrics, the Buffett metric is a guidepost and not a holy grail. I use it mainly for broad perspective, but that doesn’t mean it doesn’t have its limitations. For instance, the metric has to have an upward bias to some degree because market cap is likely to grow faster than GNP for various reasons. But there are other limitations noted in the post:

- Little UK data for the stock market to GDP/GNP

- Different countries have very different markets

- What about overseas sales?

- The ratio is often elevated, and thus arguably useless

There are some good comments as well. Check it out.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.