Thanks again for all the good questions from the recent Q&A. Here are the responses. Feel free to follow-up in the forum if you’d like.

Q: Do you think the stock market will have a more difficult time in the future now that the psychological “put” from QE is gone?

A: It’s impossible to know if QE had much of an impact on stock prices. But I don’t think it matters too much going forward. The thing is, stocks have been high flyers for the last 5 years and investors have been a bit spoiled. The high rate of return that we’ve seen in recent years is not sustainable going forward. This is especially true when we consider that corporate profits are unlikely to continue their torrid pace from the last 5 years. That’s mainly due to the fact that household saving is already very low and the contribution from dividends and business spending are likely to slow in the coming years. This doesn’t mean stocks have to perform negatively or even poorly. It just means that it’s a safe bet to assume something closer to the historical norm like an average rate of return in the mid to high single digits going forward.

Q: While it’s understood that QE can be seen as a swap of Treasuries for Reserves I would like to know who benefits from such a swap? Why banks would want to swap a interest bearing asset for a non interest bearing asset? I mean if loans are demand driven and demand is depressed what is the point to sell something interes bearing? Bref : where did money (or currency ???) go ![]() ?

?

A: The banks operate as middlemen for the Fed during QE. So they are buying bonds and on-selling the bonds to the Fed. The banks aren’t the major sellers of bonds during this. It’s the non-bank public. The beneficiaries of this are varied, but since we don’t know the true impact of QE and its effects on rates and other channels we don’t really know the extent to which QE helps certain parts of the economy. Of course, QE was largely implemented initially to help shore up banks so the banks were big beneficiaries, but one could argue that QE helped anyone who owned assets because it helped prop up prices to some degree.

Q: Most of us that have been reading Pragcap and your research papers for a while understand that banks don’t lend reserves.

How about deposits? Let’s pretend a new bank opens, but has no depositors. Can it make loans?

Also, banks certainly compete for depositors and it seems obvious that they hope those new customers pay the bank service fees, and become credit worthy borrowers. Apart from that, does the bank benefit from gathering more deposits from customers that don’t borrow money and pay minimal fees? I think a lot of people assume that banks want new deposits so that banks can do more loans.

A: A bank needs capital to make loans. And a new bank is funded with fresh capital so it meets legal requirements and can operate its payment system. So long as the bank is well capitalized it can make loans.

Banks run a payment system in which they earn a profit by maximizing the spread between their assets and liabilities. Deposits are generally an inexpensive way to maximize this spread. The banks don’t need the deposits to operate or make new loans and often lose them to other banks in the normal course of business, but they will compete to obtain deposits because they’re an inexpensive liability. A bank that does not have sufficient deposits on hand to meet its regulatory requirements will be hit with an overdraft charge at the Fed or be forced to borrow in more expensive markets. So it’s generally smart for banks to attract deposits because this is a sure fire way to avoid having to borrow more expensive forms of funding. Banks don’t need reserves or deposits to make new loans, but they do need to maximize their spread on A/L in order to maximize profits and keep the regulators happy.

Q: Could you explain the operational differences between FED QEs and Repo?

A: QE is an open market operation in which the Fed buys assets from the private sector by creating money from nothing. A repo is essentially a collateralized loan whereby one party lends an asset to another party at a specific interest rate and promises to repurchase it in the future. Open market operations are outright buys/sells whereas repos are basically loans.

Q: Cullen, Being sovereign in your own currency is critically important, as you have explained. In trying to understand emerging markets, I admit my ignorance and I’m not sure which countries are sovereign and which are not. I do know China and Brazil are sovereign. Are there any major emerging economies which lack monetary sovereignty and therefore could potentially be more vulnerable to economic weakness and other problems (such as is the case with Europe currently).? Thanks.

A: I explain this as degrees of being autonomous. That is, the USA is highly autonomous because they have no foreign debt, issue their own currency, have a massive production base they can tax, are not pegged, etc. There is a high degree of exorbitant privilege because of this. Emerging market economies often have to borrow in foreign currencies, peg their currency or have small economies which means they are not fully autonomous.

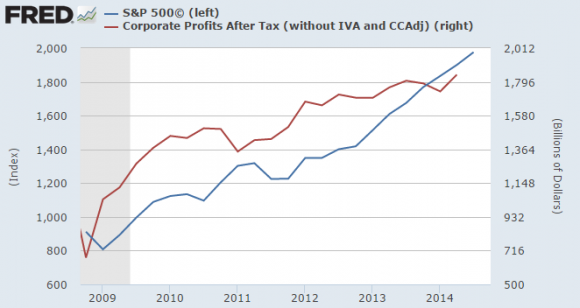

Q: How do you respond to this chart showing an almost exact correlation between Fed Balance sheet and S&P 500

A: I think that chart can be extremely misleading. It implies that there’s a necessary correlation between QE and stocks. But if you look at corporate profits there’s also a very high correlation (about 80%) so there’s a perfectly rational explanation for rising stock prices during this period. But people often use the QE chart to imply that the rally has been totally fake and not based on anything fundamental. But the surging corporate profits clearly show that there’s a real fundamental reason why stock prices have surged.

Q: Is there any circumstance where the FED can create dollars without a matching asset such as Treasury notes or bonds?

A: The Fed is only legally allowed to purchase certain assets and it does so by creating money. This results in what is effectively asset swaps. I don’t know if that answers your question, but this is how the Fed operates since it is essentially just a big bank.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.