Here’s a lovely thought – imagine a world where the Fed has induced risk taking in what is perceived as the safest of asset classes – fixed income. They’ve also convinced everyone that certain assets won’t be allowed to fall. And in keeping “assets higher than they otherwise would be” they’ve actually forced, through the portfolio rebalancing effect, the herd into assets that are not nearly as safe as US Treasury bonds, but serve a similar portfolio purpose. In other words, they’re forcing investors into privately issued assets that are intended to act like high grade bonds, but can’t ever be as risk-free as US government bonds.

Now imagine that private investors are excessively overweight what they perceive as a safe asset and consider the potential that that asset won’t perform like the low risk asset they might have thought it was. Sounds kind of like the housing bubble, right? Blackstone says that’s the world we now live in:

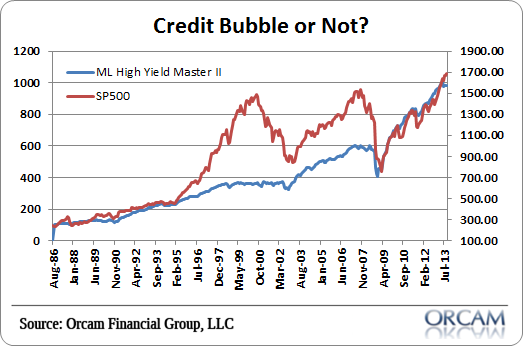

“We are in the middle of an epic credit bubble, in my opinion, the likes of which I haven’t seen in my career in private equity,” Joseph Baratta, The Blackstone Group (BX)’s global head of private equity, said Thursday night at the Dow Jones Private Equity Analyst Conference in New York City. “The cost of a high yield bond on an absolute coupon basis is as low as it’s ever been.”

Yes, while everyone focuses on the stock market, the real disequilibrium that has been potentially built up over the years has been in credit markets where the portfolio rebalancing effect has forced investors out of risk free US government bonds and into assets that serve a similar purpose in a much riskier credit structure. We’ve taken another safe asset class and forced this massive rebalancing of portfolios that has resulted in investors chasing yield to the point of actually making the market potentially more unstable than it otherwise would be.

Of course, this all works fine so long as the income is there to support the credit structure. But the big risk is a recession or a big profit recession where companies are no longer seeing the cash flows. That’s when the big risks present themselves. And if that were to occur we’d see a mass exodus out of many of these private credit markets in search of the true safe assets – US government debt. And if the Fed is still siphoning the risk free asset out of the private sector when investors most want it this could actually exacerbate the problems in other markets as the exodus into cash and cash like instruments ensues. Think 2008 style US T-bond rally all over again.

Just one more risk due to QE….And it’s totally unnecessary for us to be in this environment.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.