Wednesday’s MBA mortgage applications data highlights another glaring error in the efficacy of QE2. While the Fed loves to point to rising equity prices (while denying blame for commodities) they appear to conveniently ignore the consumer’s largest asset – housing. In the now infamous Washington Post op-ed Chairman Bernanke discussed the role that QE2 would play in helping to boost the housing market:

“Easier financial conditions will promote economic growth. For example, lower mortgage rates will make housing more affordable and allow more homeowners to refinance.”

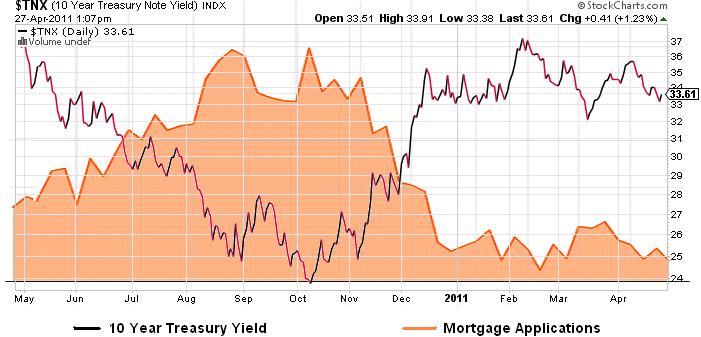

Since then we have heard nary a peep about the housing market. And that’s because mortgage rates have spiked and housing conditions have become anything but “easier”. And as we all know, the housing market remains a disaster with housing prices continuing to decline, record low sales, climbing inventories and rising interest rates. The key here is interest rates and it highlights the failure of QE2. While many academics like to point to real rates the truth is that the consumer has not noticed the benefit of this rate effect at all. This is clear in the MBA application data where you can see the perfect inverse correlation in applications and interest rates:

Mortgage applications have fallen off a cliff since QE2 began last August

As I’ve stated over and over again, this program was destined to fail from its onset because it targeted size and not price. The housing market is perhaps, the most glaring example of QE2’s failure.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.