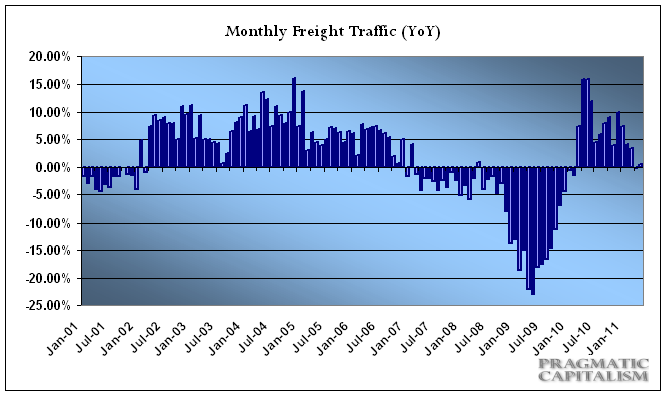

Rail traffic continues to show modest year over year growth according to the AAR. The latest weekly reading of 1.1% growth in total carloads is consistent with a growing, but sluggish economy. Intermodal was a bit stronger this week at 7.2%. The year over year rate of growth appears to have peaked late last year and the trend has been clearly lower, but still in positive territory.

Rail traffic has remained an important indicator of economic growth over the years. It was a clear leading indicator out of the 2002 recession and into the 2008 recession. The latest recovery has been stagnant and the data much more noisy (due to the extent of the declines), but I believe the rail industry is continuing to point to sub-par economic growth. This is consistent with the balance sheet recession and some government support, but unfortunately, also consistent with high unemployment and general economic malaise.

The latest rail data is detailed below (via AAR):

The Association of American Railroads (AAR) today reported steady results in weekly rail traffic with U.S. railroads originating 273,584 carloads for the week ending June 4, 2011, up 1.1 percent compared with the same week last year. Intermodal volume for the week totaled 205,565 trailers and containers, up 7.2 percent compared with the same week in 2010.

Fifteen of the 20 carload commodity groups posted increases from the comparable week in 2010. Commodity groups posting solid increases included: iron and steel scrap, up 18.7 percent; coke, up 18.1 percent, and grain, up 17.4 percent. Groups posting a notable decrease included: primary forest products, down 15.2 percent, and nonmetallic minerals, down 10.5 percent.

Weekly carload volume on Eastern railroads was up 1.9 percent compared with the same week last year. In the West, weekly carload volume was up 0.6 percent compared with the same week in 2010.

For the first 22 weeks of 2011, U.S. railroads reported cumulative volume of 6,384,231 carloads, up 3.1 percent from last year, and 4,909,266 trailers and containers, up 8.5 percent from the same point in 2010.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.