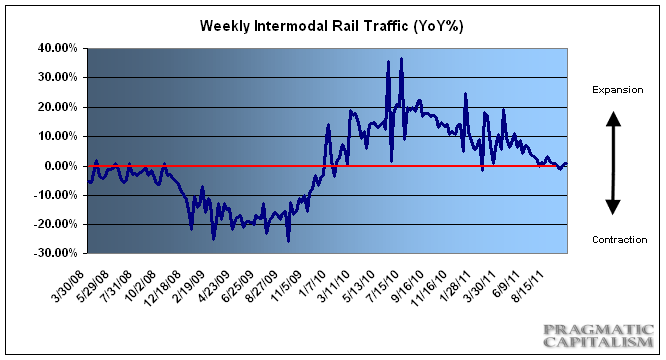

Rail traffic for the week ending September 24th posted another positive gain with carloads showing 1.1% gains and intermodal traffic showing 3% gains. I think this data is still consistent with a muddle through economy and not the substantially deteriorating economy that many are coming to expect. If we look back to 2008 you’ll actually notice that rail traffic had turned negative well in advance of the recession, but the recent data is still positive although just slightly. In short, this is far from a robust economy, but the rail traffic data does not appear to be consistent with an economy deteriorating substantially. The AAR details this week’s data:

“The Association of American Railroads (AAR) today reported gains for weekly rail traffic, with U.S. railroads originating 305,133 carloads for the week ending September 24, 2011, up 1.1 percent compared with the same week last year. Intermodal volume for the week totaled 248,402 trailers and containers, up 3 percent compared with the same week last year. This weekly intermodal volume is the highest since Week 39 of 2007.

Thirteen of the 20 carload commodity groups posted increases from the comparable week in 2010, including: metallic ores, up 21 percent; petroleum products, up 16.1 percent, and metals and products, up 16 percent. Groups showing a decrease in weekly traffic included: grain, down 21.4 percent, and waste and nonferrous scrap, down 15.5 percent.

Weekly carload volume on Eastern railroads was down 2.9 percent compared with the same week last year. In the West, weekly carload volume was up 3.8 percent compared with the same week in 2010.

For the first 38 weeks of 2011, U.S. railroads reported cumulative volume of 11,016,908 carloads, up 1.7 percent from the same point last year, and 8,630,362 trailers and containers, up 5.5 percent from last year.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.