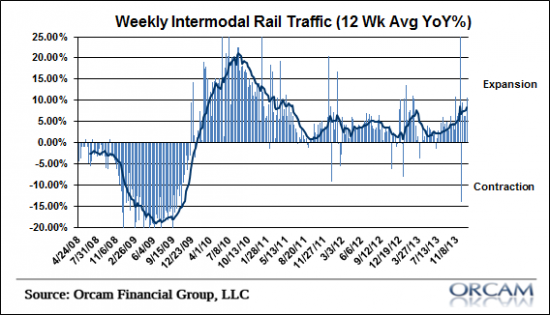

Rail traffic finished 2013 with a boom. Intermodal jumped 10.6% on the week which brought the 12 week moving average to 7.6%. That is the highest 12 week average reading since May of 2011. Here’s more details from AAR:

“The Association of American Railroads (AAR) today reported increased U.S. rail traffic for the week ending Dec. 28, 2013 with 230,933 total U.S. carloads, up 8.1 percent compared with the same week last year. Total U.S. weekly intermodal volume was 172,396 units up 10.6 percent compared with the same week last year. Total combined U.S. weekly rail traffic was 403,329 carloads and intermodal units, up 9.2 percent compared with the same week last year.

Nine of the 10 carload commodity groups posted increases compared with the same week in 2012, including grain with 18,201 carloads, up 36.8 percent; petroleum and petroleum products with 13,532 carloads, up 29.8 percent; and nonmetallic minerals and products with 19,174 carloads, up 14.3 percent. Commodities showing a decrease compared with the same week last year included metallic ores and metals with 22,064 carloads, down 7.2 percent.

For the 52 weeks of 2013, U.S. railroads reported cumulative volume of 14,608,403 carloads, down 0.5 percent from the same point last year, and 12,831,692 intermodal units, up 4.6 percent from last year. Total combined U.S. traffic for the 52 weeks of 2013 was 27,440,095 carloads and intermodal units, up 1.8 percent from last year.”

Chart via Orcam Financial Group:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.