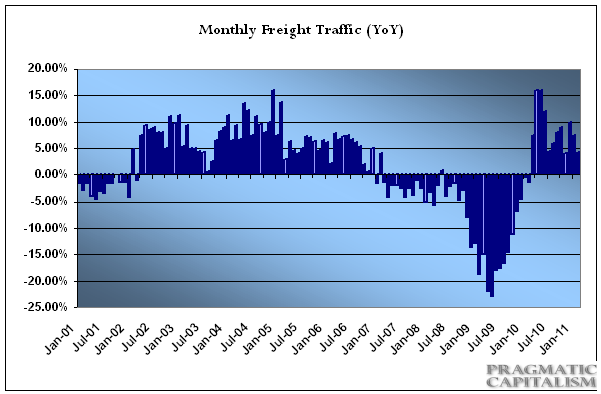

Rail traffic continued to expand in February according to the AAR‘s latest monthly report:

“The Association of American Railroads (AAR) today reported that monthly carloads in February 2011 increased 4.2 percent compared with the same month last year, for a total of 1,135,396 carloads. According to AAR’s monthly Rail Time Indicators report, intermodal traffic in February increased 10.3 percent for a total of 881,830 trailers and containers compared with February 2010.February 2011 marks the twelfth straight month for carload increases and the fifteenth straight month for intermodal traffic increases on a year-over-year basis, showing the continued gradual upward trend in rail traffic. On a seasonally adjusted basis, however, carloads were down 3 percent and intermodal was up 0.1 percent over January 2011.

“Rail traffic can be negatively affected by winter storms, and we got some of that in February,” said AAR Senior Vice President John Gray. “That said, U.S. rail carloads have now increased for 12 straight months and intermodal loadings for 15 straight months. Rising consumer confidence, an improving employment picture, and higher manufacturing output are just some of the indicators that, along with rising rail volumes, point to an economy that seems poised to continue to grow in the months ahead.”

The year-over-year increase for February 2011 is the smallest since July 2010, which may be attributed to heavy snowfall over most of the country that made rail operations more difficult.

Overall, 15 of 20 commodity categories saw carload gains on U.S. railroads in February 2011 compared with February 2010. Traffic gains in February were led by metallic ores, up 71.9 percent; nonmetallic minerals, up 12.7 percent, and motor vehicles and parts, up 11.2 percent. The five commodity categories seeing declines for the month — including grain mill products and food products — together accounted for less than 8 percent of total carloads for the month.

As of March 1, 2011, 306,316 freight cars, or 20.2 percent of the fleet, were in storage. That is a decrease of 12,457 cars from February 1, 2011.”

Source: AAR

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.