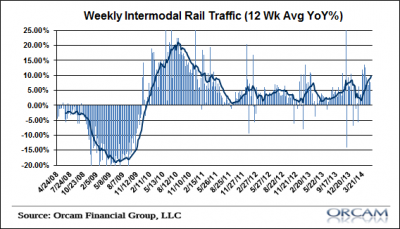

If you follow rail traffic trends there sure doesn’t appear to be any signs of economic weakness there. The latest rail traffic data showed record gains in intermodal and the highest 12 week moving average since 2011 at 8.5%. This certainly seems to validate the idea that weather substantially impacted Q1 and we’re starting to see a resurgence in Q2 data. Current Q2 GDP estimates also appear to validate this view with the consensus at 3.5% as of now.

Here’s more detail via AAR:

“The Association of American Railroads (AAR) today reported increased U.S. rail traffic for April 2014, with both carload and intermodal volume increasing compared with April 2013. Intermodal traffic in April totaled 1,316,176 containers and trailers, up 9 percent (108,485 units) compared with April 2013, and the 53rd-consecutive year-over-year monthly increase for intermodal volume. The weekly average of 263,235 intermodal units on U.S. railroads in April 2014 was easily the highest for any April in history and was the second highest for any month in history.Meanwhile, U.S. carload originations totaled 1,481,586 in April 2014, up 6.4 percent (88,801 carloads) over April 2013. Fourteen of the 20 commodity categories tracked by the AAR each month saw year-over-year carload increases in April. Commodities with the biggest carload increases included coal, up 34,502 carloads, or 6.4 percent; grain, up 22,683 carloads, or 27.6 percent; crushed stone, sand and gravel, 10,194 carloads, or 9.5 percent; and petroleum and petroleum products, up 5,316 carloads, or 7.6 percent.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.