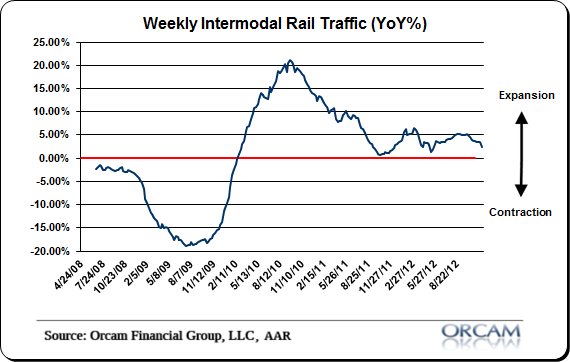

Rail traffic turned down sharply this week as intermodal traffic dipped -6.2%. That brings the 3 month moving average to 2.7%, down sharply from last week’s reading of 3.5%. One week doesn’t make a trend, but rail trends haven’t been negative since 2009 so this is one to keep a close eye on if things continue to deteriorate. Here’s more from the AAR:

“AAR today also reported declines in rail traffic for the week ending Nov. 3, 2012, which included impacts from Hurricane Sandy. Last week U.S. railroads originated 278,230 carloads, down 6.8 percent compared with the same week last year, while intermodal volume for the week totaled 224,467 trailers and containers, down 6.2 percent compared with the same week last year.

Ten of the 20 carload commodity groups posted increases compared with the same week in 2011, with petroleum products, up 61.5 percent; farm products excluding grain, up 46.4 percent, and lumber and wood products, up 24 percent. The groups showing a decrease in weekly traffic included iron and steel scrap, down 25.8 percent; metallic ores, down 22.9, and nonmetallic minerals, down 22.5 percent.

Weekly carload volume on Eastern railroads was down 12.7 percent compared with the same week last year. In the West, weekly carload volume was down 3 percent compared with the same week in 2011. “

(Chart via Orcam Investment Research)

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.