Sorry for the blunt title, but I couldn’t think of anything more appropriate….

I was watching the Republican debate this evening when Rand Paul made the following comments on the Federal Reserve in response to rising income inequality:

“By artificially keeping interest rates below the market rate average ordinary citizens have a tough time earning interest and a tough time making money. They’re actually talking now about negative interest rates.

…The money, as it’s created, through QE or by other means, tends to start out at the big banks in New York. And because we’re now paying interest for them to keep the money there the money doesn’t filter out into the rest of the economy.

…We also find that as the Federal Reserve destroys the value of the currency what you’re finding is that, if you’re poor, if you make $20,000 a year and you have 3 or 4 kids and you’re trying to get by, as your prices rise and the value of the dollar shrinks, these are the people who are hurt the worst.”

Okay, that’s all very wrong. But first we should note that Rand Paul belongs to the so-called Austrian Economics school, a school that has been so fantastically wrong about everything since 2008 (inflation, rising rates, government debt problems, etc) that it is amazing anyone still has the guts to say they believe in the many myths and fallacies promoted by this “school”. But let’s touch on each point above because Paul’s misunderstandings make for a good learning moment:

Myth: Interest rates are “artificially low” and low interest rates cause income inequality.

Reality: The Fed has not kept interest rates artificially low. Interest rates are low because the economy is weak.

People sometimes talk about the Fed as if it controls the entire economy. No, the Fed sets overnight interest rates by responding to economic growth. More importantly, the Fed only controls the overnight rate. It does not set the entire term structure of interest rates across the economy. And as I’ve explained before, the natural rate of interest on overnight loans is 0% because a banking system with excess reserves will push the overnight rate to 0% as banks try to lend their reserves. In other words, the Fed always has to manipulate the overnight rate UP, not down. But this is a function of the Fed’s perception of economic growth. With very weak growth and virtually no inflation the Fed has responded by keeping rates low. Interest rates aren’t “artificially low”, the economy is fundamentally weak.

Further, the recent interest rate environment has not been hard on savers. Yes, it’s been hard on depositors who have not had a diversified savings portfolio, but anyone who has owned stocks, bonds and cash has done quite well for themselves. Rand is always quick to accuse the Fed of artificially boosting stock prices, but then conveniently contradicts himself when he says that savers have been hurt by low interest rates. No, undiversified savers have been hurt by low interest rates.

Related:

Myth: Banks lend reserves and paying interest on reserves incentivizes banks not to lend.

Reality: Banks lend first and find reserves later. Interest on excess reserves does not stop banks from making loans to creditworthy borrowers.

Rand’s second statement is clearly an old school money multiplier comment. This has been thoroughly refuted by the Fed, the Bank of England and many others in recent years. Banks don’t lend their reserves. Banks make loans and find reserves after the fact if they must. Banks are required to hold a certain amount of reserves, but they do not need reserves before they can make new loans.

Paying interest on reserves has nothing to do with lending. As noted above, banks don’t lend their reserves so they’re not holding reserves because they want to earn interest on reserves. And in the aggregate banks can’t control the quantity of reserves they hold as reserves don’t leave the Fed Funds market. QE was implemented to make banks much safer entities and more capable of making loans because it improved their capital position. The problem is not a lack of high quality banks, but a lack of high quality borrowers. This is why lending has been low in recent years.

Related:

- The Myth of the Money Multiplier

- Cutting IOER Will Not Stimulate Lending

- More Reserves Do not Allow Banks to Make More Loans

- The Basics of Banking

Myth: The Fed has Created High Inflation and Debased the Dollar

Reality: The Fed can’t seem to stimulate the weak economy and the dollar is at a 10 year high.

Inflation has been very low in recent years by almost any metric. The Fed can’t seem to do anything to create enough inflation. This fact seems to be missed by people hanging onto the myth that QE is inflationary despite the fact that commodities are deflating at a record pace, the global economy teeters on deflation and all public and private measures of inflation show very low readings.

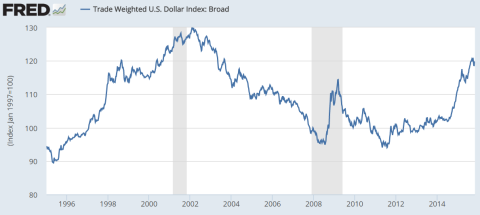

Further, the US Dollar has been on a huge tear in recent years and is currently at a 10 year high. Low inflation and a surging dollar clearly aren’t consistent with the idea that the Fed “destroys the currency”.

Related:

I’m not quite sure why anyone still associates themselves with Austrian Economics. I know it’s a politically appealing “school”, but it has so many operational flaws in its understandings of the economy that it can’t be taken seriously.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.