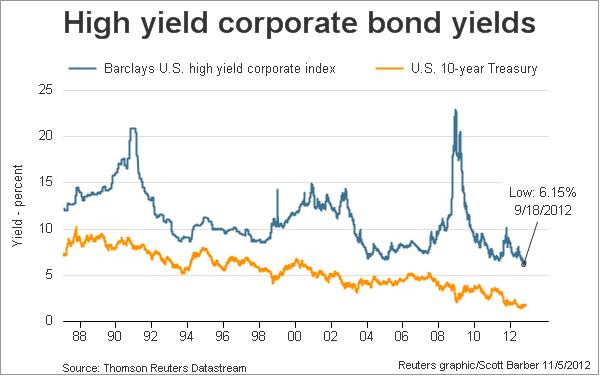

Good overview here from the Reuters Alpha Now Research team on the current unusual state of the junk bond market:

“The junk bond, or high-yield bond, universe has seen yields decline steadily in both absolute and relative terms, creating a financing bonanza for companies whose credit rating is below investment grade and for the banks underwriting their debt issuance. But questions about corporate earnings may provoke questions about whether investors’ hunger for interest income has driven valuations too high, and yields too low.

Yields on so-called junk bonds have hit almost surreally low levels over the course of 2012, due to a combination of the intense hunger for income on the part of investors and the equally astonishing level of yields on Treasury securities. The spread between those ‘risk free’ Treasury notes and their junk bond counterparts fell in mid-October to only about 531 basis points, meaning that many companies with a below-investment grade rating were able to snag financing on terms that an investment-grade issuer would have been happy to acquire throughout much of the last decade. An average ‘junk bond’ issuer (as measured by the Bank of America Merrill Lynch U.S. High Yield Master II Index) can expect to raise new funds in exchange for an annual yield of less than 7% as of the end of October.”

Read the full piece here.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.