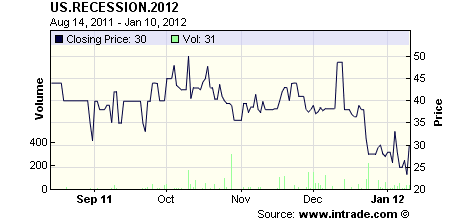

The odds of recession are declining substantially. At least that’s the story Intrade is telling us. Intrade is an online market that trades mostly political events, but a range of other events as well. According to the latest Intrade market data the odds of recession in 2012 have fallen to 30% from a recent high of nearly 50%.

I’ve long been saying that odds of recession are very low in 2012 for various reasons and my opinion there hasn’t changed much. I still think the balance sheet recession is likely to end in the coming couple of years and that marginal improvement in the private sector de-leveraging situation combined with high federal deficits will bolster the economy this year. It’s not enough for a strong year, but muddle through is probably about right….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.