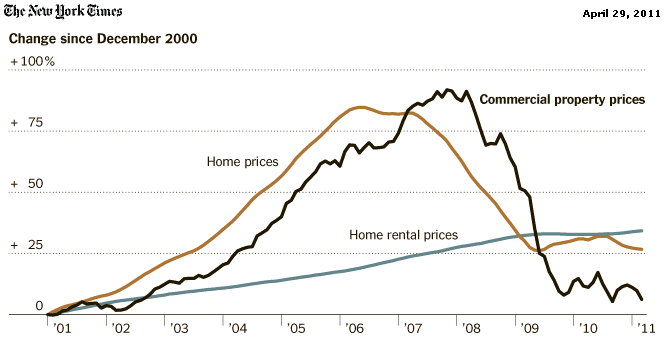

As the NY Times highlighted this weekend, commercial real estate is also falling again:

PRICES for both homes and commercial real estate are falling again. Meaningful improvement may have to wait until there are many fewer distressed properties for sale.

Indexes of the two markets showed this week that the latest declines had almost wiped out the mild gains the two markets had shown after prices appeared to have hit bottom.

The Standard & Poor’s/Case-Shiller index of home prices ended February 3.3 percent below where it was a year earlier, and just 0.5 percent above the low reached in May 2009. The Moody’s/REAL Commercial Property Price Index was reported to be down 4.9 percent over the last 12 months, but still 0.8 percent above its low, reached last August.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.