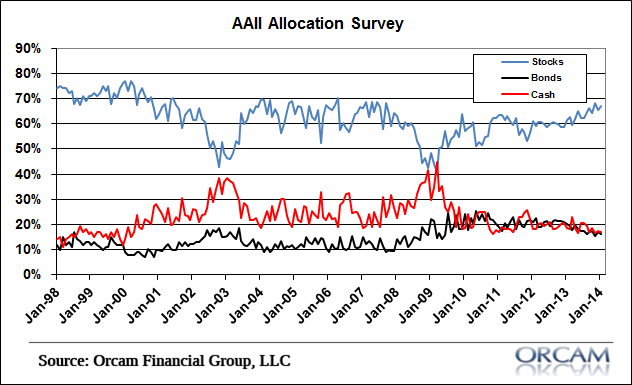

The latest AAII asset allocation survey showed a continued upward crawl in retail investor stock bullishness. The latest equity allocation reading came in at 66.9% which is above the historical average of 60%. This is the eleventh straight month of 60%+ readings which is the longest streak since before the financial crisis.

This is one of those indicators that is most useful at extremes. In particular, it’s been helpful in locating secular market bottoms. So, I don’t know how helpful this is in a market environment like the present. If anything, I think the fact that we’re off the historical highs tells me that we’re not at the type of euphoric point that would be alarming.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.