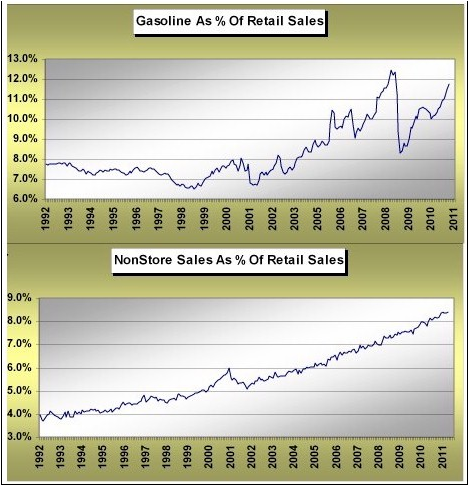

Some people have been quick to tout the rebound in retail sales as a sign of the strength in the economy and the positive impact of QE2, but a recent article by Brian Pretti at Financial Sense helped put this story in the proper perspective. When one looks under the hood at the actual retail sales increase you find a trend that is oddly similar to the CPI data. The surge in retail sales is largely due to the increased consumption expenditures in gasoline:

“The picture by now should indeed be crystal clear. The ONLY category of retail that has been growing its sales as a percentage of total retail sales over both of the QE periods has been gasoline, again leaving the non-store retailing trends aside. And this is Mr. Bernanke’s wealth effect? To be honest it has indeed worked wonders for wealth generation – the wealth of crude oil producers, that is. The collective and very simple message is that there has been no wealth effect at all if one defines that as an increase in discretionary consumption. The Fed has incited commodity and equity speculation in its QE heroics, with the results being the rising cost of gasoline has acted to “displace” alternative forms of discretionary retail spending. Too bad the mainstream media simply seems not to have had the time over the last few years to dig beneath the pretty retail sales headlines, no? For this is exactly what they would have found.”

So yes, QE has certainly helped to boost retail sales. Unfortunately, it’s helped mainly by reallocating funds from other goods and services into this one non-discretionary cost. And that’s not helping the US economy.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.