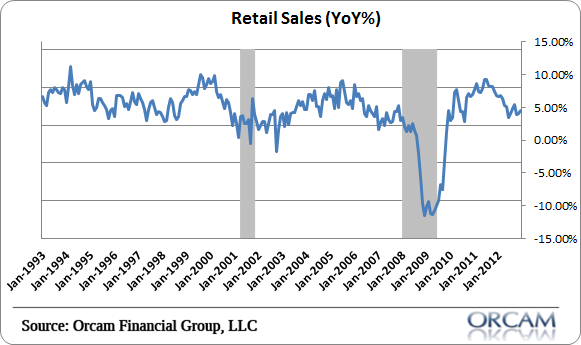

This morning’s retail sales report showed some small signs of deterioration, but still pointed to a positive overall level of demand in the economy. According to the Census Bureau retail sales came in at a year over year rate of just over 4%. This has tended to be a pretty good leading indicator of recession so it would be unusual to see this sort of figure during a recessionary environment.

In my opinion, the budge deficit and modest improvement in private investment are still enough to keep the consumer spending at a slow pace. That means no recession, tepid growth, modest corporate profit expansion and a jobs environment that is okay, but not strong enough to bring us anywhere near full employment.

Here’s more from the CB:

“The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for January, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $416.6 billion, an increase of 0.1 percent (±0.5%)* from the previous month and 4.4 percent (±0.7%) above January 2012. Total sales for the November 2012 through January 2013 period were up 4.5 percent (±0.5%) from the same period a year ago. The November to December 2012 percent change was unrevised from +0.5 percent (±0.3%).

Retail trade sales were up 0.1 percent (±0.5%)* from December 2012 and 4.1 percent (±0.8%) above last year. Nonstore retailers were up 15.7 percent (±2.3%) from January 2012 and auto and other motor vehicle dealers were up 9.4 percent (±2.3%) from last year.”

Chart via Orcam Investment Research:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.