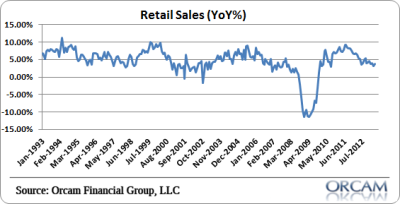

Retail sales came in slightly better than expected this morning, but are still consistent with a rather sluggish economy. The year over year rate of change was +3.7% which is well off the 2011 post recession high of 9.2%, but still growing modestly. We’ve tended to see negative readings in this data prior to recessions so there’s a silver lining in the weak single digit reading.

Here’s more detail via Econoday:

“Headline retail sales edged up despite a decline in gasoline prices. Core sales actually were somewhat healthy. Retail sales increased 0.1 percent, following a drop of 0.5 percent in March (originally down 0.4 percent). Analysts forecast a 0.3 percent decline. Motor vehicles were unexpectedly up 1.0 percent after a 0.6 percent dip in March. Unit new motor vehicle sales slipped in April but from high levels, according to manufacturers’ data.

Ex-auto sales in April slipped 0.1 percent after decreasing 0.4 percent in March (originally down 0.4 percent). Market expectations were for a 0.1 percent dip. Gasoline sales fell on lower prices. Excluding both autos and gasoline components, sales gained a strong 0.6 percent, following no change in March (originally down 0.1 percent). The consensus called for a 0.4 percent rise in April.

Core strength was in building materials & garden equipment; clothing; nonstore retailers; general merchandise; and food services & drinking places. There may be some seasonality issues but discretionary spending appears to be picking up. While there are signs of soft spots in the recovery (specifically manufacturing), the consumer sector may be gaining some momentum.”

Chart via Orcam Investment Research:

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.