I’ve spent an excessive amount of time in the last 7 years talking about the various market distortions that QE can cause (I even dedicated a paper to the commodity bubble in 2011). I would argue that the two primary places where these distortions occurred were in the commodity markets and the corporate bond market (though probably less directly attributable in the commodity market).

The thinking relative to commodities was very simple. QE created the belief that high inflation was on the horizon so commodity producers saw huge inflows of demand for “real assets”. There were all sorts of strange things happening in the markets over the last 7 years including Chinese farmers hoarding cotton in their kitchens, copper producers essentially securitizing their holdings to make loans, investment banks holding inventories of oil, etc. These were moves that were designed to anticipate the coming inflation from QE’s “money printing”, which never came of course because QE doesn’t create high inflation (as I’ve repeatedly explained).¹

The current debacle in commodity markets goes beyond the slowdown in China. It is, to a large degree, a capitulation in the idea that QE causes high inflation. This has been most notable in the precious metals markets which are often viewed as the best commodity to hold to protect against inflation. Back in 2011 I explicitly stated that the silver market was in a bubble with prices over $40. The current collapse is a complete reversal in the “QE causes inflation” view.

The more recent market debacle is occurring in high yield bonds which has similar bull market origins. This is another market that I’ve expressed concerns about over the years thanks to distortions from QE. Again, the thinking is very simple. QE reduces the quantity of safe high(er) yielding fixed income assets in the private sector. As the private sector is forced out of these holdings they search for similar alternatives. Since the safest high(er) yielding instruments have been removed from the aggregate pool of options investors have no choice but to demand alternatives. QE essentially dilutes the quality of the outstanding pool of options forcing investors to reallocate into riskier alternatives.

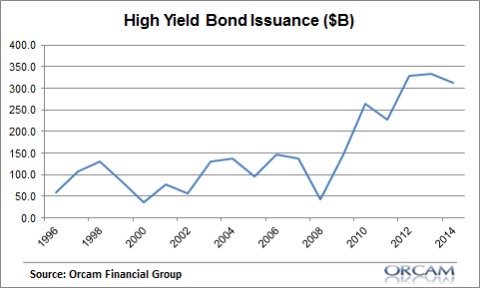

As a result of this we’ve seen very high levels of corporate bond issuance and junk bond issuance in particular:

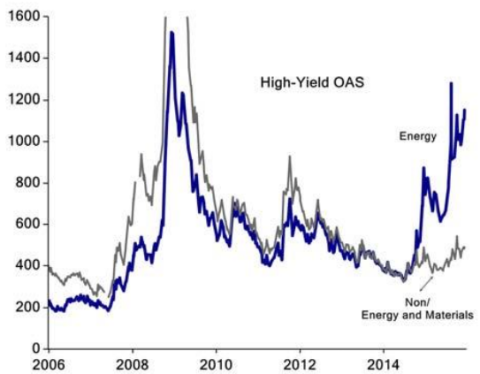

QE created a supply/demand imbalance in the private sector which resulted in an environment that actually destabilized the aggregate pool of securities. In macroeconomic research this is the “safe asset shortage” problem. QE not only failed to create the inflation it was intended to create (because people don’t spend more money when they simply swap assets), but it also reduced the overall credit quality of the private sector’s financial assets. So, as we see deterioration in credit spreads I don’t think we should be all that surprised:

The bigger question for most investors is why do they own high yield bonds in the first place? I’ve personally never really understood the purpose of owning junk bonds. In fact, I don’t even know why we call them bonds. Yes, from a legal perspective we identify these securities as “bonds”, but from a market practitioner’s perspective they’re really more like a crappy version of equity since they have many of the volatility aspects of equity without the same high returns.

Since 1985 high yield bonds have generated an average annual return of 8.1% with a standard deviation of 9.8. An aggregate bond index has generated a 7.1% average return with a standard deviation of 5.2. The risk adjusted returns in the aggregate bond index were far better over this period as Sharpe and Sortino ratios show dramatically better results. Perhaps most importantly, high yield bonds failed to do what bonds should do – protect investors from permanent loss risk. In addition to a 30% decline peak to trough during the financial crisis high yield bonds have consistently generated 8%+ declines in portfolios since 1985 while the bond aggregate has never experienced a calendar year decline greater than -3%. Being sector specific in the high yield bond market has failed to justify the higher risk profile of this segment of the bond market. This has to make an investor wonder – why would they want to own this component in the first place?

It’s all a very disconcerting picture. We’ve become so dependent on the Fed for policy moves that I have to wonder if this dependence is actually serving public policy well. The evidence from the last 7 years does not bode well.

¹ – Understanding QE

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.