This is a pretty interesting bit of research from VOX on wealth and income inequality. It shows that in a world of hyperglobalization the biggest losers in terms of inequality are the richest countries:

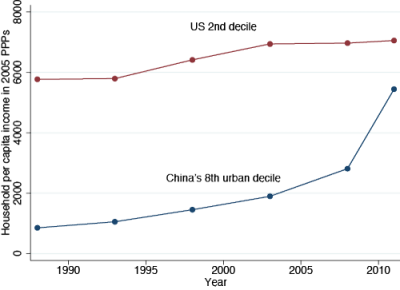

“A dramatic way to see the change brought by globalisation is to compare the evolution over time of the 2nd US income decile with (say) the Chinese urban 8th decile (Figure 3). Indeed we are comparing relatively poor people in the US with relatively rich people in China, but given the income differences between the two countries, and that the two groups may be thought to be in some kind of global competition, the comparison makes sense. Here we extend the analysis to 2011, using more recent and preliminary data. While the real income of the US 2nd decile has increased by some 20% in a quarter century, the income of China’s 8th decile has been multiplied by a factor of 6.5. The absolute income gap, still significant five years ago, before the onset of the Great Recession, has narrowed substantially.”

This is a point that Thomas Piketty highlights in his controversial book Capital. He says:

“the very rapid growth of poor and emerging countries, especially China, may well prove to be a potent force for reducing inequalities at the global level”

This doesn’t mean that inequality can’t be harmful in the developed world. But I don’t think we should be terribly surprised that hyperglobalization is in fact increasing inequality in the developed world and reducing it in many emerging markets. After all, in a truly global monetary world we should see a substantial convergence in incomes as time goes on. This is a trend that isn’t coming to a stop any time soon and in fact could be accelerating. So yes, there is a certain degree of “the rising tide lifts all boats” occurring here. The problem is, some of the boats are rising more slowly than others as hyperglobalization leads to faster wealth and income gains in the emerging markets.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.