A lot of people have started asking me about some of these Robo Advisor services like WealthFront and Betterment in recent months. I’ve started digging into the businesses in more detail, but while I am in the process, I did want to pass on some pretty cool news from Vanguard – they’re getting into the game also.

The rise of the Robo Advisor is good and bad. I’ll add details later, but the good news is that these low fee providers are driving down costs, automating processes (portfolio management is all about process, process, process) and driving out bad advisors. I also think they’re perfectly positioned to help the lower income investor which is great news for people who are hesitant to pay up for something they might not need. Those are huge wins for everyone who’s an investor. But the Vanguard product is cool because it takes Vanguard’s low cost platform, embeds automation AND offers you the personal touch that is often necessary with financial planning and portfolio advisory. As Erik Brynjolfsson says, we have to learn to work with the machines, not against them. Vanguard seems to have gotten the message.

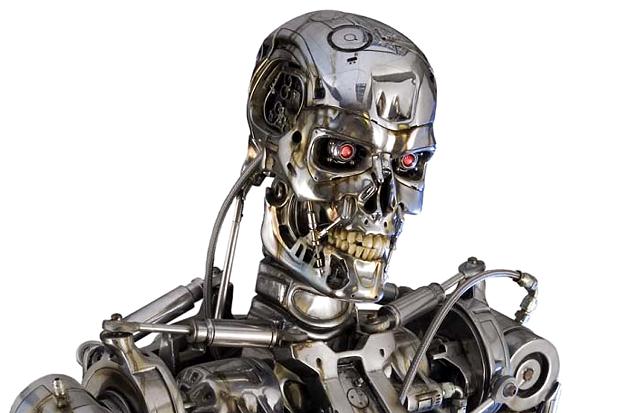

This is all good news. I’ve long said that the biggest problem in the investment business is the fee structure and if nothing else, this is fantastic news for all involved (except maybe the Robo Advisors who now have to compete with the giant they kicked in the shins). And hey, while we’re all complaining about the economic consequences of the rise of the robots, let’s not forget that a lot of good is coming from it as well. This being exhibit A.

* I have no business relationship with any of the firms mentioned above. I am just an independent financial consultant watching them all duke it out….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.