Robo Advisors are all the rage these days. They’re heralded as being superior to other investment services because they use automation to streamline the asset allocation process. This is certainly true when compared to high fee active mutual funds, but the benefit of a robo is far less clear when compared to traditional passive index funds. I’ve stated on several occasions that Robos are just a different style of product wrapper not much different from target date funds. This has been hard to prove until recently when consistent performance reporting appeared.

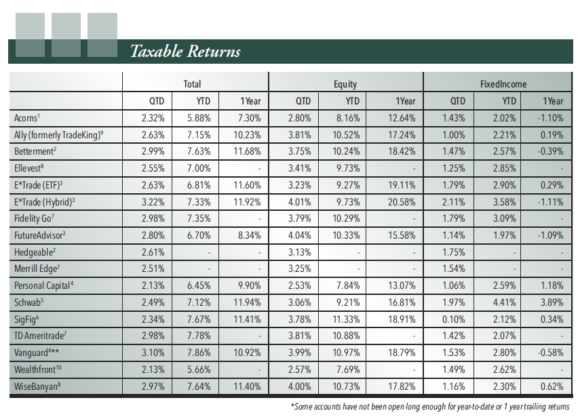

The Q2 2017 Robo Report confirms my initial thinking on this matter – robos are just mimicking index fund performance and generally doing so in exchange for higher fees.¹ In the report the 1 year track record for all available Robos is listed:

What’s interesting about the available 1 year data is that it is benchmarked to a traditional 60/40 index. When compared with a 60/40 LifeStrategy Fund from Vanguard the Robos averaged 10.6% 1 year returns vs the Vanguard fund which averaged 10.93%. Vanguard LifeStrategy Moderate Growth Fund costs just 0.14% while pure Robos cost 0.38% on average and 0.67% for a hybrid (human and robo such as Vanguard Personal Advisor or Personal Capital).

If you’re not too lazy to rebalance once every few years you could have allocated your assets across a simple 4 fund global 60/40 index using 30% VXUS, 30% VTI, 20% BND & 20% BNDX. This portfolio did even better with 11.27% 1 year returns and cost you just 0.07% per year. So, if you owned a Robo in the last few years there’s a very good chance that you paid an extra 0.3-0.6% in fees on average to own something that does what existing product wrappers already do.

It all begs the question – are Robos a better product wrapper or are they just a product wrapper with better marketing?

¹ – Q2 2017 Robo Report, BackendBenchmarking

NB – I should be clear that I think Robos are a wonderful development in that they will force down costs across the investment advisory space. They are light years superior to most hedge funds and active mutual funds. But I am still having trouble justifying the idea that anyone who needs the pure Robo service (no human help) should be paying 0.4% or more for something that Vanguard has offered for a long time and currently offers at a much lower cost structure.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.