David Rosenberg has long been stressing an income oriented approach to the markets. It’s a bit more cautious than a pure growth driven approach and more appropriate for the investor who is not willing to take excessive risk. He says the strategy is still intact and outlines his approach in this morning’s letter:

“Indeed, just take a look at what is happening with long-dated Fannie Mae mortgage yields, which have fallen 30 basis points since the start of the year to 2.66%. There is lots of anticipation of another round of QE coming from the Fed, with the emphasis back on mortgage paper (page C4 of the WSJ cites sources as being as low as $400B of upcoming Fed buying to as much as $750B).

Also look at how great REITs have been performing, with an average yield of 4.34% last year versus 1.87% for a 10 year T-note. Apartment housing has been one positive feature for the real estate market and REITs in this space delivered a 15% total return for investors last year. One area that got beaten up last year because of rising recession risk was hotel REITs, but if the Fed’s recent Beige Book commentary on travel and tourism has a kernel of truth to it, or if there is validity to the explosive jobs growth/tourism industry (up nearly 3% in the last year) then this could well be a nice turnaround story for income hungry investors.”

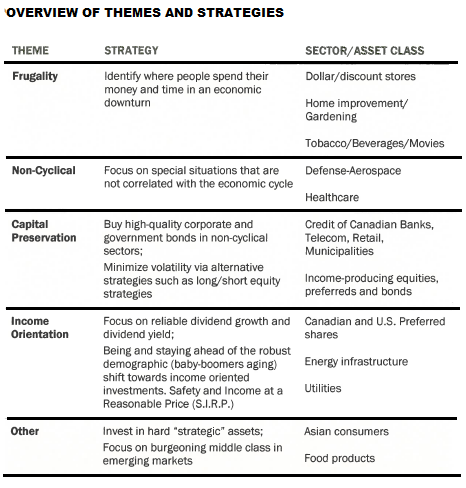

Source: Gluskin Sheff

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.