I watched the CNBC Republican Presidential Debate last night. It was the first of the debates that I have tuned into and it was a pretty good one. I thought Mitt Romney was the clear winner and the consensus seems to think so as well. He’s beginning to sound very Presidential. I don’t know if that’s necessarily an entirely good thing, but when compared to the other candidates there just doesn’t seem to be anyone else on the docket that can hold a candle to him.

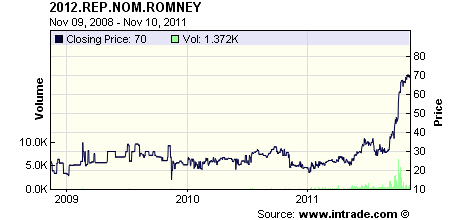

Intrade now has Romney at a 70% chance of being the 2012 candidate for President. Newt Gingrich is running a distant second with less than 10%. The other candidates are all sitting at less than 5% odds. In other words, if the markets have this right Romney is in the driver seat.

Romney’s an attractive candidate in many regards, but in the midst of an economic crisis, it’s impossible not to overlook some of the misconceptions he propagates. And I’d be lying if I said that economic policies aren’t the driving force of my vote. I tend to fall into the camp that a President is only as good as the economy he presides over. In other words, if people have jobs and feel comfortable everything else sort of takes care of itself. Clearly, there’s more to life than that, but the economy is by far the most important fact.

Some of Mr. Romney’s economic talking points are alarming. For instance, last night he said that the USA was facing a crisis that would turn us into Italy. He said:

“And right now America faces a crisis. I think people on both sides of the aisle recognize that this is no longer just a time for worrying about the next election. This is a time to worry about America. We see what’s happening in Italy. What’s happening in Greece. That’s where we’re headed if we don’t change our course.”

This is just flat out wrong. When someone compares the nations of Europe to the USA they are proving that they don’t understand how the monetary system works. Greece is a currency user analogous to a state, business or household in the USA. They are not analogous to the Federal Government who is a currency issuer. This is a colossal error which will inevitably lead to very bad policy. The US government’s balance sheet is nothing like a currency user’s balance sheet. In fact, the entire cause of the crisis in Europe is this fact that the countries lack sovereignty. The fact that they are not currency issuers is the cause of this failed monetary system. I am not going to sit here and repeat all of my rants about the modern monetary system, but this is a very alarming statement.

Mr. Romney wants to claim that his years of business experience provide him with the upper hand in being able to get America back on the right track. But if he can’t even get the basics right then we really shouldn’t expect much from him. And this doesn’t even dive into the fact that he’s already teamed up with Greg Mankiw and Glenn Hubbard – two of the leaders in neoclassical (read, mythical) economic thinking….

Mitt Romney might win the Presidency by scaring Americans into thinking that we are the next Greece, but I can assure you that he won’t get America back on the right track with this sort of flawed understanding of the monetary system. If he wants to really help America he should start by understanding how the system actually works. Only then can he begin to craft an economic team and a plan that will really help us out of this rut. Of course, the bad news is that the sitting President has an equally poor understanding of all of this. So, this election might just turn into a decision of choosing which foot you like better and firing your pistol right into the other one.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.