The debate over secular stagnation is all the rage today, but I want to throw out another potential option – the golden era of low and stable growth. If we look at the growth in the US economy it’s clear that we’re becoming a lower growth economy. But this might not be all bad because while the rate of growth is slowing the quality of our growth isn’t necessarily deteriorating.

In terms of the global economy the US economy has become rather mature. That is, we’ve captured so much market share in the last 200 years that it would be utterly shocking if the US economy was able to hold onto it all or expand on it. So it’s likely that the US economy is seeing some reduced growth on a relative basis due in large part unsustainable market share capture. To put this in stock market terms we can think of the US economy as a mature high quality dividend paying stock. And if this is the case then we should be happy to accept some degree of lower growth in exchange for more stable growth.

If we expand on this analogy to the stock market we can compare the risk adusted returns of US economic growth over time. Since 1950 NGDP has averaged 6.6% with a standard deviation of 3.5. Since 1970 the quality of that growth actually improved a bit with the same 6.6% growth rate, but a standard deviation of just 3.15. And since 1990 growth has slipped to 4.6%, but the standard deviation has slipped even more to 2 (this includes the recent financial crisis). That is, in each subsequent 20 year period the quality of our growth has actually improved a bit because it has become increasingly stable.

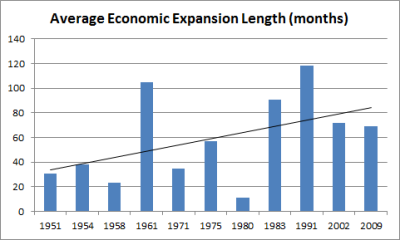

Not only that, the length of expansions has also increased over this period. Prior to 1980 the average expansion was just 48 months while the average expansion has lasted 72 months in the period after.

When placed in this context the idea of low growth doesn’t seem so bad because it’s been relatively stable growth. So, maybe, just maybe, if “secular stagnation” looks like a high quality dividend stock then it isn’t so bad after all?

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.