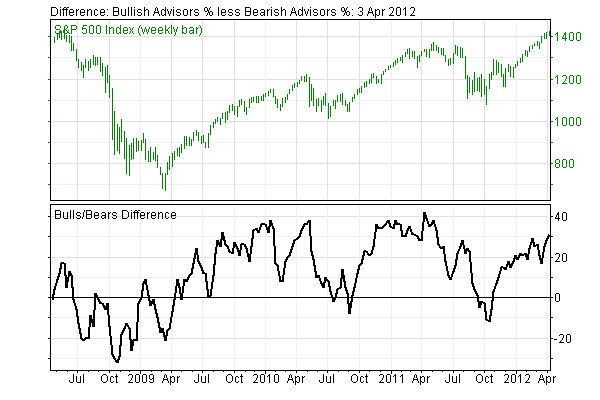

Here’s the latest from Investor’s Intelligence on the 9 month high in the bull/bear spread:

“After a second weekly gain just above 2% the bulls were 52.7%, from 50.5% a week ago. Their number is up 9.1% over the last three weeks, from 43.6% and their lowest number since Oct-11. Many bulls noted the US index strength as reflecting the best prospects of any of the major world economies. The latest reading for the bulls is the most since early Feb-12 when they were 54.8% with that market peak. Just over a year ago, at the Apr-11 peak the bulls were 57.3%. We often see readings in the 55%-60% area with a major market top.

The bears fell again to 21.5%, from 22.6% last time. That drop equaled their Jul-11 low with an even lower reading earlier that April, when indexes all achieved highs. That historic low of 15.7% showed nearly everyone was a bull. It would not surprise us to see the bears below 20% over the upcoming weeks for a sign of a market top. They also fell below 20% in mid Oct-2007.

…The difference between the bulls and bears expanded further +31.2%. It was +27.8% last time. The latest data exceeded the early February spread of +29.0%, the widest positive margin for more than nine months. That missed negative territory by a fraction but the new reading is now there. A spread above 30% suggests danger for a rising market. Last April it reached a dangerous +40% difference. In contrast it was pointing to a rally with a negative reading of -11.9% at the start of October. This is a contrarian indicator. Wide negative spreads [below zero] show low risk for new positions. High readings [above zero] signal increasing risk.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.