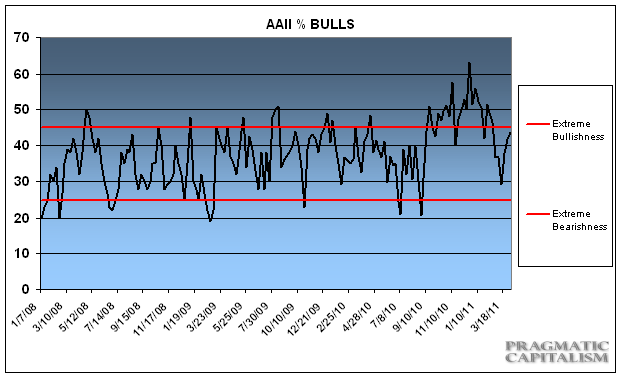

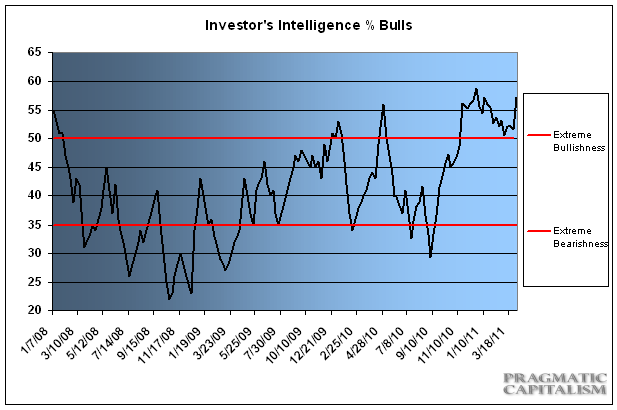

After a brief dip in recent weeks, sentiment has shot back towards its highs. Although I’ve had trouble finding any definitive connections between QE2 and real economic growth, there is one certain connection – QE2 is having an enormous impact on investor psychology. Since QE2 began we have had a persistent optimism in the markets. This is clear in both of the major sentiment surveys I track where sentiment has remained at a permanently “extreme” range throughout QE2.

This week’s readings take us back towards this extreme level. Charles Rotblut of AAII elaborated on the AAII survey:

“Bullish sentiment, expectations that stock prices will rise over the next six months, improved 1.8 percentage points to 43.6% in the latest AAII Sentiment Survey. This was the third consecutive weekly increase and it puts optimism at a seven-week high. The historical average is 39%.Neutral sentiment, expectations that stock prices will be essentially unchanged over the next six months, remained essentially unchanged for the second consecutive week at 27.6%. The historical average is 31%.

Bearish sentiment, expectations that stock prices will fall over the next six months, fell 2.2 percentage points to 28.8%. This was the third consecutive decline in pessimism, which is now at a seven-week low. The historical average is 30%.”

The Investor’s Intelligence survey is showing an even more extreme trend. This week’s reading surged 5.7% to 57.3%. Investors are extremely bullish.

Thus far, this optimism has only fueled equities throughout QE2. Although QE2 is unlikely to have much of an impact on the fundamental economy we have to begin wondering what will happen when this persistent confidence high gets sucked out of the market?

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.