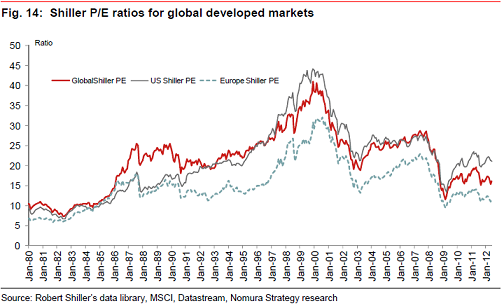

Just a little 30,000 foot perspective here on global valuations. The following comes courtesy of Nomura Research. It shows the global Shiller P/E ratios. Interestingly, the USA is now the expensive market while Europe has become considerably less expensive.

Via Nomura:

“Figure 14 shows the Shiller P/E analysis extended to Europe and global developed markets.

Currently, there is a significant difference between the valuations of US, global and European stock markets. At 16x, the global market is at the third decile (ie. cheap compared with history), whereas Europe at 11.4x is at its cheapest level since the 1980s apart from the immediate post Lehman bankruptcy period.”

Source: Nomura

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.