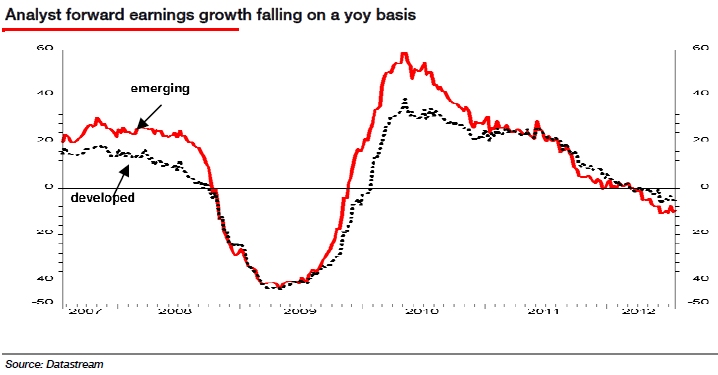

I wish there was better news to report on the profits front, but there just isn’t much to like about the current outlook for corporate profits. And as Albert Edwards of SocGen recently noted, it’s been a slow bleed as analysts expectations turn increasingly negative:

“Let me quote from Andrew Lapthorne Of course this is a particularly silly reporting season period, where on one hand earnings estimates have collapsed, yet on the other the majority of companies are producing positive surprises. Such silliness will only encourage the idea the equity market is increasingly not really fit for purpose . However there is no denying that earnings optimism is currently very weak, registering a lowly 34% globally and a terrible 27% in the US. Fixating on the forecast growth rate for this year is of course misleading as these can evaporate very quickly, best to look at year-on-year changes in 12-month forward or trailing earnings which are now showing many region profits to be in decline (see chart below).”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.