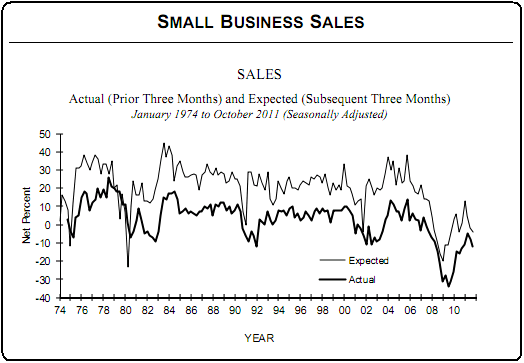

This morning’s NFIB report from small businesses highlights the continuing problem with the domestic economy. Revenues are simply too low to justify optimal investment in the USA. This is nothing new of course, but it does highlight the ongoing issue in the USA – revenues are just too damn low and this represents a lack of aggregate demand due to the balance sheet recession. Via the NFIB:

“The net percent of all owners (seasonally adjusted) reporting higher nominal sales over the past 3 months lost 2 points, falling to a net negative 12 percent, more firms with sales trending down than up. Twenty-six (26) percent of the owners indicated “poor sales” as their top business problem, not surprising with the frequency of reported weaker sales trends. This is not a level of economic activity that will support job creation. The net percent of owners expecting higher real sales gained 2 points to a net negative 4 percent of all owners (seasonally adjusted), 17 points below January’s reading.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.