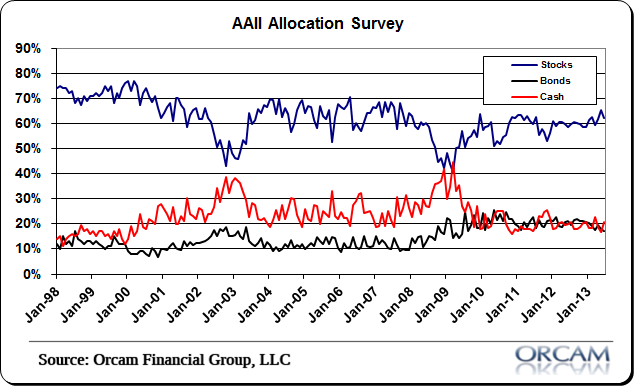

Not much to report in the AAII’s July investor allocation report. Overall allocations were little changed amid reported uncertainty (via AAII):

The numbers are indicative of the ongoing uncertainty facing individual investors. Current stock valuations, uncertainty about when the Federal Reserve will begin tapering its bond purchases and frustration with a lack of key progress by Congress and the president are all influencing AAII members’ sentiment towards stocks and bonds. Many of AAII members take a long-term approach towards their portfolio allocations and although there are small changes, nothing has occurred to prompt the majority of survey respondents to make significant changes with their allocations.

Last month’s special question asked AAII members what changes they made, if any, in response to the S&P 500’s 18% rise during the first seven months of 2013. One out of four respondents (26%) said they haven’t made any changes. Approximately 16% of respondents said they raised cash, while 14% said they increasd their equity allocations. Bond allocations were reduced by 11%.

Here is a sampling of the responses:

· “I have taken some profits on bond funds and held cash for a market dip in dividend paying stocks.”

· “The only real change has been to sell stocks I felt were extremely high and purchase others I thought were rather low.”

· “I moved to shorten my duration on investment grade bonds.”

· “I moved a significant amount of my portfolio into cash.”

· “I’ve been slowly increasing cash. Long term, I’m still positive on equities, but I’m waiting for a better entry point.”

· “Pretty much no change; bond expirations have been boosting my cash balance.”

Stock allocations were up slightly to 62.3%, bond allocations were unchanged and cash holdings were down just slightly.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.