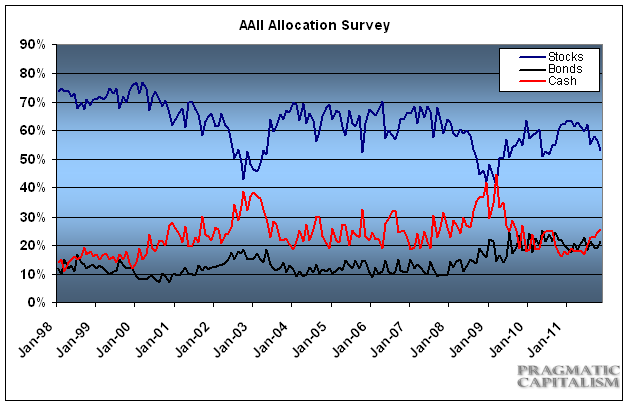

The most recent data from the AAII on small investor portfolio allocations showed a sharp move away from risk assets and into cash and bonds. Charles Rotblut from AAII elaborates on the data:

Individual investors responded to last month’s market’s volatility by increasing their cash and bond allocations according to the November AAIIAsset Allocation survey. Allocations to cash reached a two-year high.

Stock and stock fund allocations fell by 3.4 percentage points last month to 53.1%. This was the smallest percentage allocated to equities since July 2010. November was also the fourth consecutive month that equity allocations were below their historical average of 60%.

Bond and bond fund allocations rose by 2.3 percentage points to 21.2%, a three-month high. November was the 30th consecutive month that fixed income allocations were above or at their historical average of 15%.

Cash allocations increased 1.1% to 25.7% last month. The last time cash allocations were higher was November 2009, when investors kept 27.1% of their portfolios in cash. The historical average is 25%.

November’s volatility, combined with slow economic growth, the European sovereign debt crisis and Washington politics, caused AAII members to take a more conservative stance. Individual investors became more pessimistic about the short-term outlook for stocks, with bearish sentiment rising throughout the second half of November. Many individual investors are also frustrated with the inability of the stock market to sustain an upward trend and the historically low yields offered by bonds.

This month’s special question asked AAII members why they were allocating to cash in their portfolios. The majority of members said they are looking or waiting for future investment opportunities. Several expressed a belief that stock prices could be cheaper next year. Short-term savings was the second most common response, followed by money set aside for retirement withdrawals. Many respondents said they are holding cash to protect against ongoing market volatility.

November Asset Allocation Survey results:

- Stocks/Stock Funds: 53.1%, down 3.4 percentage points

- Bonds/Bond Funds: 21.2%, up 2.3 percentage points

- Cash: 25.7%, up 1.1 percentage points

Asset Allocation details:

- Stocks: 26.3%, down 2.6 percentage points

- Stock Funds: 26.8%, down 0.8 percentage points

- Bonds: 4.6%, down 0.2 percentage points

- Bond Funds: 16.7%. up 2.6 percentage points

Historical Averages

- Stocks/Stock Funds: 60%

- Bonds/Bond Funds: 15%

- Cash: 25%

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.