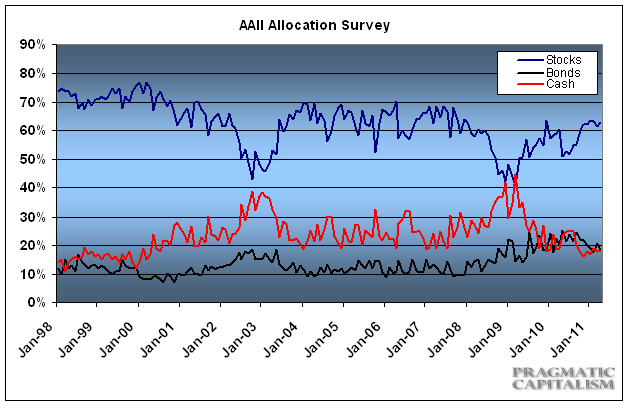

The AAII’s investor allocation survey shows a bit higher risk tolerance heading into the most dangerous 6 months of the year. Small investors upped their equity stake to 63%, up from 61% last month. Although this is a sign of increasing bullishness on the part of small investors it is still well below the euphoric levels we have seen during past major market peaks when we saw allocations over 70%. Charles Rotblut of AAII has more details on the release:

“Individual investors increased their stock and stock fund holdings last month, according to the April AAII Asset Allocation Survey. Allocations to equities and equity-based funds rose 1.5 percentage points to 62.9%. This was the seventh consecutive month that stock and stock fund allocations were above their historical average of 60%.

Fixed-income allocations fell 2.0 percentage points. Individual investors held 18.6% of their portfolios in bonds and bond funds. Even with the decrease, April marked the 23rd consecutive month that fixed-income allocations were above their historical average of 15%.

Cash allocations edged up 0.5 percentage points to 18.5%. April was the 10th consecutive month that cash holdings were below their historical average of 25%.

Despite last month’s changes, equity and fixed-income allocations remained largely within the range that has existed since last November. The relative level of stability in portfolio holdings is not surprising given that our Sentiment Survey has been showing a cautious level of optimism, with both bullish and bearish sentiment near their historical averages. Furthermore, individual investors continue to face the crosswinds of improving corporate earnings, an economy that is improving at an uneven pace, rising fuel and food prices, and concerns about the direction of interest rates.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.