Here’s a contrarian view for you (via Societe Generale):

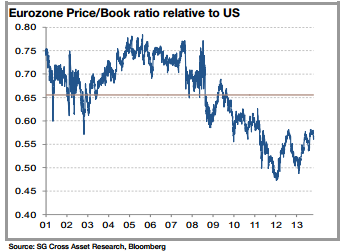

“Financial markets have taken note of the improving situation in southern European countries, with major equity indices and bonds posting double-digit performances over the past six months. Although an acceleration of the recovery may not be in the cards for the moment, we believe it is still time to invest in peripheral assets considering: 1) the ECB should remain accommodative; 2) attractive valuations compared to the US (more expensive) and EM (more risk ahead). In particular, in book value terms, eurozone and peripheral valuations are still attractive compared to the US which is trading at 2.6x book value whereas the eurozone is trading at 1.5x (the historical discount is 34%, vs 43% at present), leaving room for further performance of European assets.”

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.