Just passing along some good macro thoughts from the SocGen Cross Asset Research team:

Theme 1: Emerging market turmoil

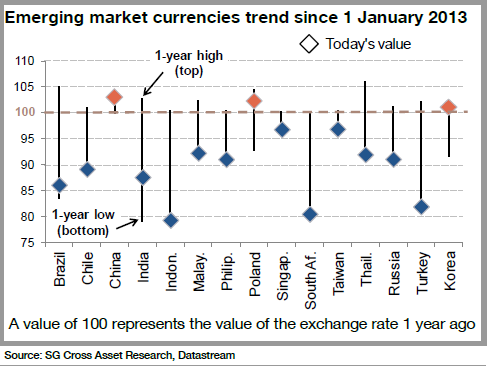

2013 was a year of much turmoil for emerging market currencies, with some falling by as much as 20% vs the USD. In this environment, few currencies proved to be resilient (China, Korea, Poland) and most emerging market currencies are now close to one-year lows. The summer of 2013 reminded us that risks are rising in emerging markets as some of the growth drivers there from the past decade (rising commodity prices, cheap labour, global growth, etc.) have disappeared. In 2014, as growth is slowing in many EM countries, the GDP growth differential between developed countries and emerging markets is at its tightest since 2009. Beware of emerging markets in Q1 14, and especially China

where the risk of a credit crisis is increasing.Theme 2: Convergence in the eurozone

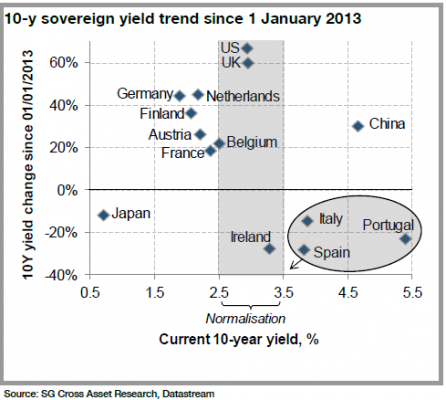

Last week eurozone economic confidence increased to 100 (from 98.4 in November), reaching the highest level since July 2011. Economic conditions are improving even in some of the hardest hit peripheral countries, with Spain posting the sharpest rise in its services PMI since mid-2007, according to our economists. But the survey data is at best consistent with a weak economic recovery and points to fears of continued disinflation or even deflation. We will therefore be watching closely to see if spreads continue to converge, as we expect, given the support of accommodative ECB policy. Last week, the spread between Southern European countries and Germany fell to a historical low, below 200bp (from over 500bp a year and a half ago). The success of Ireland’s launch of a 10-year bond reflects renewed investor interest for these assets. We maintain our positive stance on peripheral

countries, both equities and bonds.Theme 3: Corporate profitability in the US

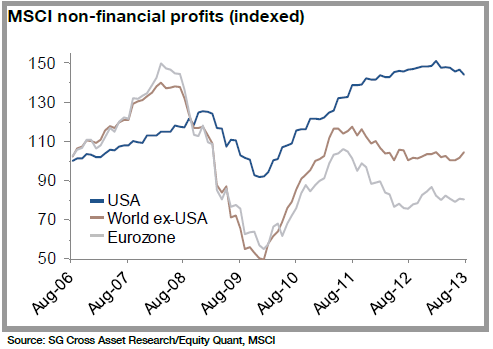

Among developed economies, the US will achieve the highest growth rate thanks to the return of consumer confidence and the pickup in private investment. The Fed’s policy is normalising from fewer asset purchases to more forward guidance, but should remain highly accommodative during the year. Overall, the macro environment is now positive for US stocks, but, after the strong expansion of multiples in 2013, investors will be watching corporate profitability more closely. EPS have reached a historical high thanks to cost reductions and share buybacks. If corporate margins can be sustained, the equity rally still has further to go, as US stocks should reap the benefits of better economic fundamentals.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.